1. Amazon (AMZN) -- Q2 2023 Earnings Review

a. Demand

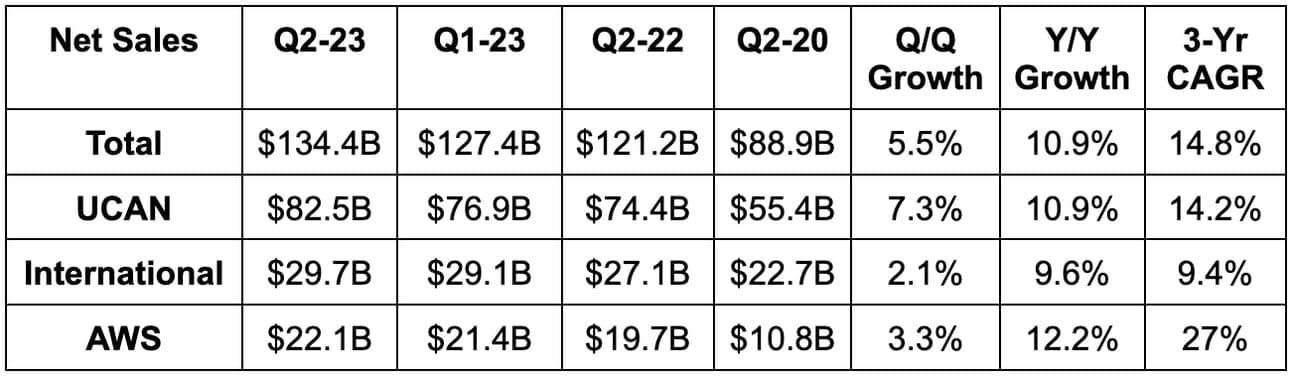

- Beat revenue estimates by 3.4% & beat guidance by 2.4%.

- Beat AWS revenue estimates by 2.8%.

Demand Context:

- 14.8% 3-yr revenue CAGR vs. 19.1% last Q and 19.5% 2 Qs ago.

- Advertising revenue rose 22% Y/Y vs. 21% Y/Y growth last quarter.

b. Profitability

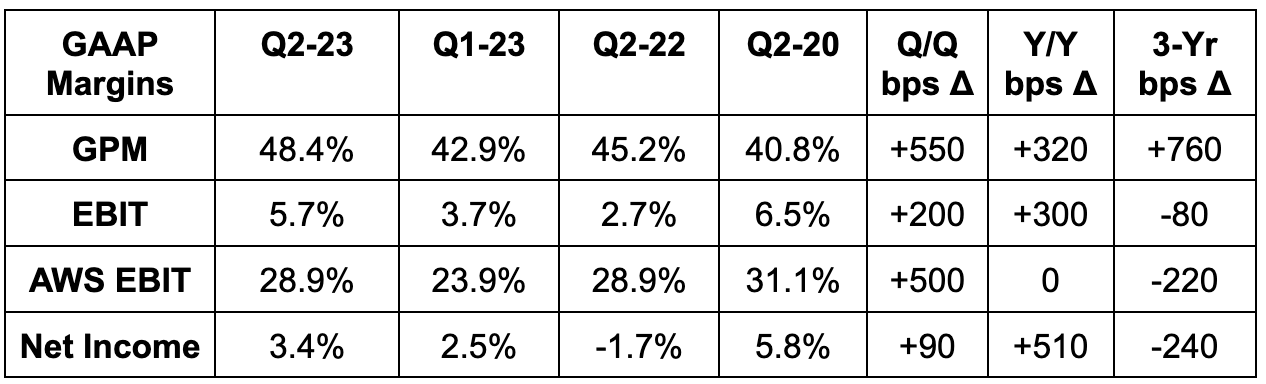

- Beat GAAP earnings before interest and tax (EBIT) estimates by 67%.

- Beat $0.34 GAAP earnings per share (EPS) estimates by $0.31.

- GAAP Gross margin beat estimates by a robust 210 basis points (bps).

Margin context:

GAAP net income is very noisy due to mark to market equity valuation swings with its Rivian stake. This quarter, it enjoyed a $200 million valuation benefit vs. a $3.9 billion hit Y/Y.

c. Guidance

- Beat revenue estimates by 1.6%.

- Beat EBIT estimates by 30%.

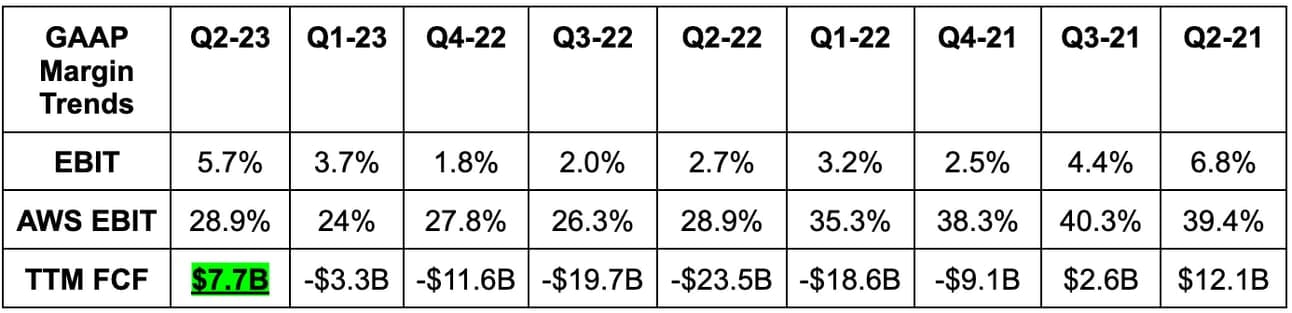

- Capital expenditures for 2023 to be $50 billion vs. $59 billion Y/Y as it expects FCF to ramp going forward. CapEx will grow within AWS despite (support AI infrastructure) falling overall.

d. Balance Sheet

e. Call & Release Highlights

Fulfillment:

Amazon continues to get faster with deliveries as customers reward these efforts with better conversion and higher future purchase consideration. During the quarter, Amazon fulfilled more than 50% of Prime Member orders in its 60 largest U.S. markets same day or next day. Its same or next day deliveries have quadrupled vs. 2019. While service improves, it is beginning to see its fulfillment efficiency overhaul bear fruit. As a reminder, it’s transitioning its national U.S. footprint to 8 local regions. This means less miles to fulfill, faster service and lower cost. Thus far, this change has cut touches per package by 20%, reduced miles to fulfill by 19% and bolstered the proportion of packages shipped within local regions. Its smaller, same day facilities are now the fastest growing fulfillment mechanism for the business. This is great news considering the format comes with the lowest costs out of any Amazon fulfillment flow. Following the success here, it now plans to double its footprint of these smaller, more local warehouses.

The margin tailwinds continue. 60% of Amazon sales came from 3rd party sellers which is a new company record. That business is higher margin than its 1st party revenue. It also continues to layer on high margin sponsored ad placements with a recent algorithm update juicing returns and lowering cost per impression for buyers. Finally, Amazon Hub Delivery will allow it to tap into local business partners to add fulfillment capacity without building out fixed costs. When taking this all together, not only does Andy Jassy see UCAN marketplace EBIT margin getting back to 4% like it was in 2019… he sees more upside beyond that. The thesis is playing out. The last 5 quarters of Q/Q margin expansion based on reduced costs and ramping growth is just the beginning.

- Raised selection in the U.S. Amazon store with Dyson, Ralph Lauren Fragrances and a deepening partnership with Victoria’s Secret. Amazon is its only 3rd party retail selling partner.

- Subscribe and Save (allows Prime Members to schedule routine deliveries) has crossed $1 billion in cumulative consumer savings delivered and tens of millions of subscribers.

- Amazon Day Deliveries (allows members to pick a day out of a week to get packages) is leading to 30% fewer boxes used for fulfillment (combined deliveries).

AWS:

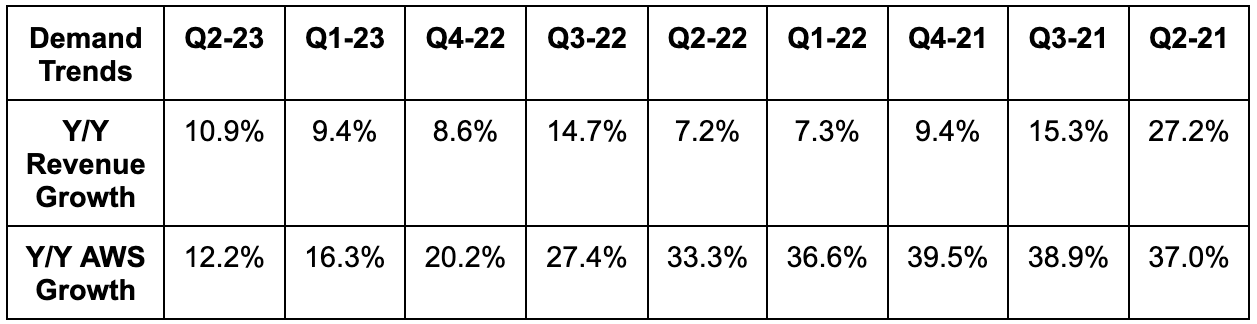

Amazon leadership talked about an encouraging cloud customer shift from optimization usage to adding new workloads. This led to growth stabilizing at 12% Y/Y during the quarter while that stability continued through July.

Jassy talked again about the different layers of AI. Model training with prediction and inference seasoning is first. This is where Amazon’s chip sets (trainium for training and inferentia for inference) are key. They supposedly offer great cost and efficacy advantages for model seasoning and will be a great complement to Nvidia’s supply constrained H100 chips. For example, its Graviton CPU chipset raises performance by 40% per Jassy.

Model creation as a service is another layer where Amazon’s foundational large language model (LLM) called Bedrock comes into play. Bedrock allows developers to openly and easily customize and build on top of it for business-specific use cases. Other pieces of Gen AI include consumer applications like ChatGPT as well as automation tools like Amazon CodeWhisperer which will directly compete with Microsoft Copilot.

Amazon will not directly monetize generative AI tools for now. It’s focused on “democratizing access by lowering costs and boosting access to companies of all sizes and talents” to take advantage of the wave. Its approach mirrors Meta’s more closely than Microsoft’s.

Amazon discussed previously announced products from its recent AWS event. Highlights can be found in this article.