During the week, we published a Meta earnings review article which can be found here. We also sent out an Alphabet + Microsoft earnings review article which can be found here.

1. Visa (V) & Mastercard (MA) -- Earnings Reviews

As these two card networks represent over $5 trillion in spend volume combined, their performance can be taken as a great indicator of current consumer and economic health.

a) Visa

Results vs. Expectations

- Beat revenue estimates by 0.7%.

- Roughly met revenue estimates.

- Met EBIT estimates.

- Beat $2.12 EPS estimate by $0.04.

Demand Context:

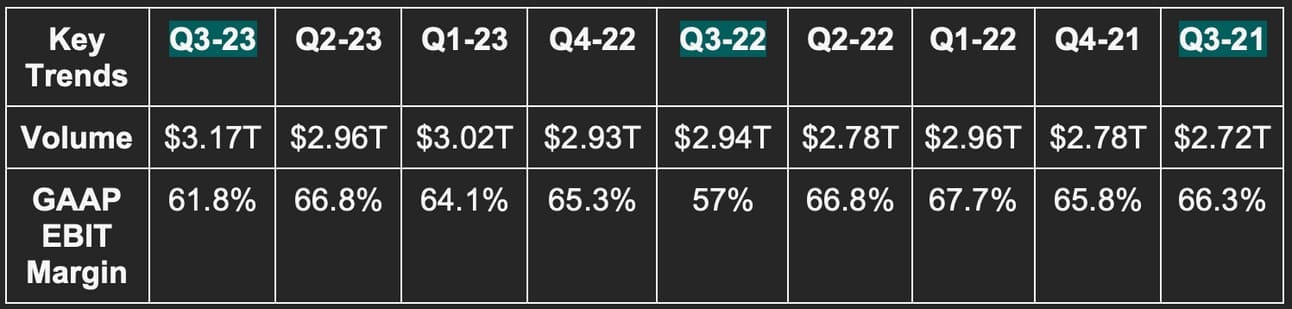

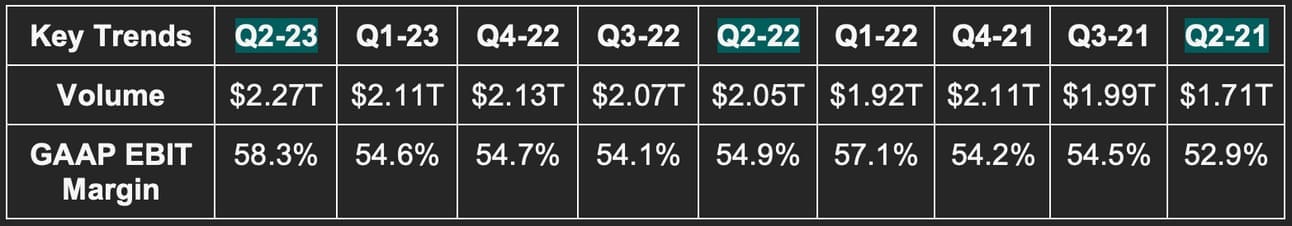

- 18.8% 3-yr revenue compounded annual growth rate (CAGR) vs. 11% Q/Q & 9.5% 2 quarters ago.

- Foreign exchange neutral (FXN) revenue growth was 12.6% Y/Y.

- Service revenue rose 15% Y/Y; data processing revenue rose 15% Y/Y; international transaction revenue rose 14% Y/Y.

- The demand headwind from exiting Russia has been officially lapped.

- Card growth was 7% Y/Y vs. 7% Y/Y posted last quarter.

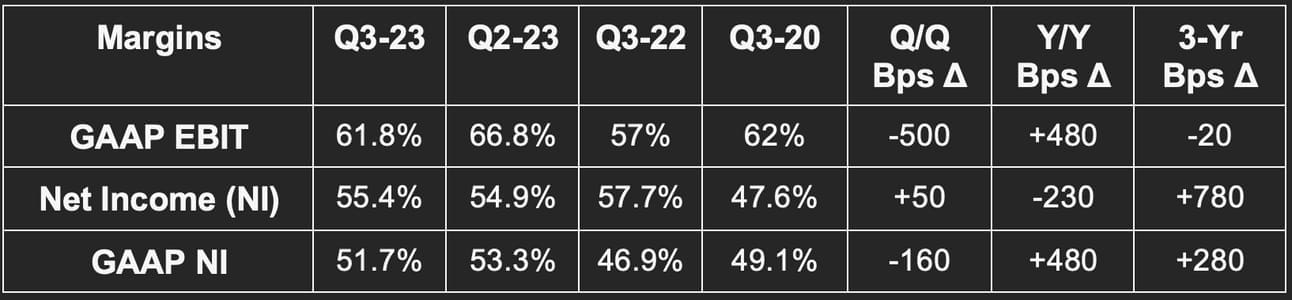

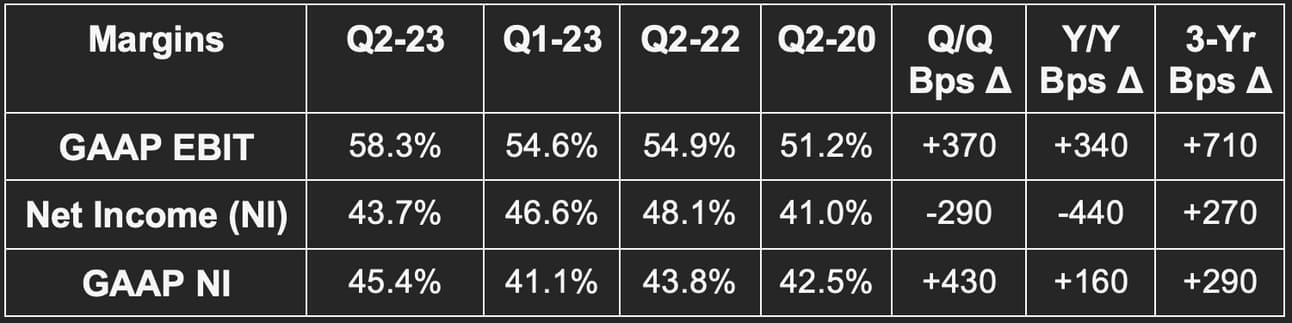

Margin Context:

- GAAP operating expenses (OpEx) fell 1% Y/Y with non-GAAP OpEx rising 10% Y/Y when excluding litigation charges from the Y/Y GAAP comparison.

- GAAP EPS rose 25% Y/Y with non-GAAP EPS rising 9% Y/Y (11% FXN).

- Year to date free cash flow of $13.1 billion vs. $12.3 billion Y/Y.

- Client incentives = 28.1% of gross revenue vs. 26.7% Q/Q & 26.1% Y/Y. Higher is worse.

Guidance

Visa offered the following commentary and data about the consumer heading into August:

- Cross-border travel is quickly recovering and will continue to do so next quarter.

- Cross border e-commerce improvement is expected to continue. Great news for firms like PayPal.

- Quarter to date, U.S. payments volume is up 6% Y/Y for both credit and debit. This marks stable growth for debit and slight acceleration in credit. International quarter to date growth followed a similar trend.

Fiscal Year Q4 2023 guidance:

- 10% Y/Y revenue growth which roughly met expectations.

- Non-GAAP OpEx to grow by about 7.5% Y/Y.

- Client incentives to be 28% of gross revenue vs. 26.9% of gross revenue Y/Y.

Fiscal Year 2023 guidance:

- Low double digit net revenue growth was ahead of estimates and led to upward revisions.

- Mid teens EPS growth led to a small raise in consensus EPS estimates.

- 2023 EBIT estimates rose by 1.6% following the release as well.

- Client incentives to be 27.5% of gross revenue vs. 26.0% Y/Y.

Balance Sheet

- Dividends up 17% Y/Y.

- $9.5 billion in buybacks vs. $9.5 billion Y/Y.

- $20.9 billion in cash and equivalents.

- $20.6 billion in debt.

Visa added $500 million to a litigation escrow account. This has the same GAAP accounting impact on earnings as buying back shares as it minimizes eventual share count by limiting class B conversions.

Call & Release Highlights

Consumer Health:

Leadership mimicked the commentary we heard from Mastercard, Bank of America, J.P. Morgan, American Express and others on a surprisingly resilient consumer. This strength drove volume and transaction growth that outpaced internal expectations. Strong cross-border travel demand helped there as well.

Growth Metrics:

- Cross-border volume rose 17% Y/Y. This volume is up 49% vs. 2019 levels.

- International payment volume rose 12% Y/Y. International volumes are 43% ahead of 2019 levels.

- U.S. debit & credit spend rose 6% & 5% Y/Y respectively. Overall payments volume rose 6% Y/Y. The slowing vs. the March quarter was attributed to disinflation across categories like fuel. Great news for everyone else besides the networks.

- Ticket size fell 2% Y/Y due to disinflation. Again, great to hear.

- U.S. volumes are 54% ahead of 2019 levels.

- Card-not-present growth led card present as e-commerce spend re-accelerated.

- Outbound travel to the U.S. and Asia travel overall were notable strong points. Inbound travel to the U.S. has been a more sluggish recovery.

Value Add Services (like consulting, fraud protection and data analytics):

Visa’s value-add services continue to lead to key customer wins as they did for Mastercard. It signed Rakuten Group (largest e-commerce player in Japan) as a new customer thanks to these services that Rakuten wanted to bundle into its card network relationship.

- Value-add service revenue rose 19% Y/Y FXN.

- New agreement with Pay.UK for its RTP Prevent (fraud prevention) tool to score risk for each transaction.

New Flows:

- New flows revenue rose 20% Y/Y FX neutral (FXN).

- Signed SAP for its Visa Direct (peer-to-peer payments) product. Visa will embed this tool into SAP’s tech stack to allow its employees to transfer money directly in the SAP ecosystem.

- Visa Direct revenue rose 20% Y/Y.

- Expanded Visa Direct agreement with Revolut to now include 89 markets.

- Cash App renewed its agreement with Visa Direct (and a few value-add services).

Visa Direct growth was held back during the quarter by a client churning from the platform. It chose to build an internal ledger system which will slow Visa’s growth here for a few more quarters. The effect on long-term growth potential was called “minimal.”

Take

This was a rock-solid quarter. Consumer spend continues to be surprisingly durable which bodes very well for the soft-landing macro thesis. July data points to that resiliency continuing through Q3. Its value-add services are delivering brisk, asset light, high margin growth. Its new revenue flows provide a foothold into multi-core banking technology and peer-to-peer payments as a top of funnel for new customers. It is heartening to hear how well the cross-border and e-commerce recoveries are going. That should mean companies like PayPal, Airbnb, Shopify and countless others will be enjoying similar tailwinds when they all report in the coming weeks. A fine quarter from an elite team and an iconic, deep-moat company.

b) Mastercard (MA)

“We delivered strong results supported by resilient consumer spending, particularly in travel and experiences, and the continued strength in services.” -- CEO Michael Miebach

Results vs. Expectations

- Beat revenue estimates by 1.6% & beat its guidance by 1.8%.

- Beat EBIT estimates by 2.4%.

- Beat $2.81 GAAP EPS estimates by $0.08.

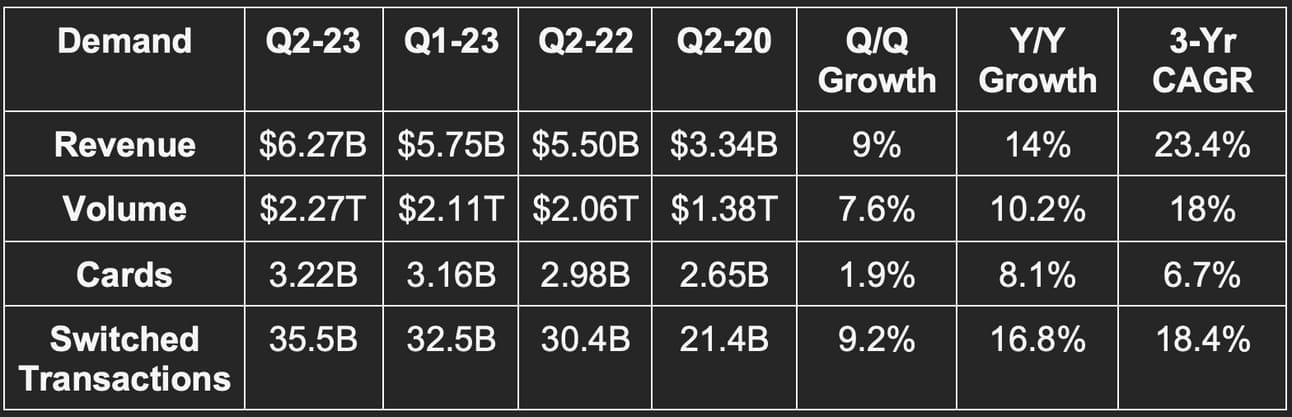

Demand Context:

- Just like for Visa and American Express, Travel & Entertainment (T&E) was cited as a category stand-out this quarter and into next quarter. That bodes very well for the sectors involved.

- Cross-border travel is 54% above 2019 levels for Mastercard as of now.

- Switched Volume rose 6% Y/Y in the USA and 16% Y/Y for Rest of World.

- FXN revenue growth was 15% Y/Y.

- Payment network revenue rose 13% Y/Y (14% FXN) while value add service revenue rose 16% Y/Y.

- Assessment (AKA fee) growth by bucket:

- 10% Y/Y growth for domestic assessments.

- 27% Y/Y growth for cross-border assessments. Strong.

- 16% Y/Y growth for transaction processing assessments.

- Online click to pay growth reached 70% Y/Y for the quarter as it launches the feature in more markets.

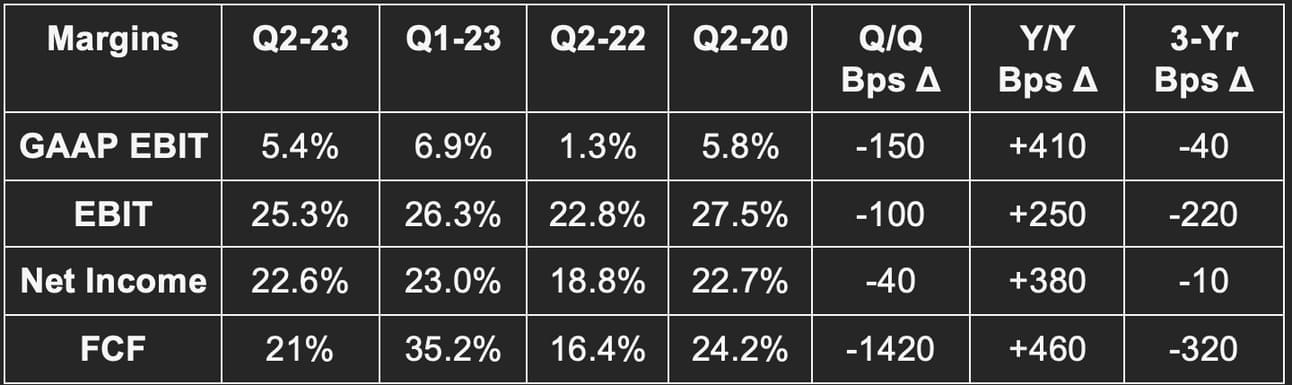

Margin Context:

- Operating expenses rose 12% Y/Y on a non-GAAP basis and 5% Y/Y on a GAAP basis when excluding one-time charges like in litigation.

- GAAP EPS rose 28.2% Y/Y while non-GAAP EPS rose 12.9% Y/Y when excluding one-time comp tailwinds in the Y/Y period.

- This growth was hurt by a 23.2% effective tax rate vs. 18.7% Y/Y.

- Incentives and rebates rose 22% Y/Y to outpace demand growth.

Guidance

Mastercard reiterated its previous guidance calling for low teens Y/Y 2023 revenue growth and high single digit non-GAAP OpEx growth. This was largely as expected.

For the month of July, growth metrics are holding up very well. Overall volume growth is steady at 7% Y/Y in the USA. International growth is 14% FXN quarter to date. Cross-border volume is holding up quite well with 22% Y/Y growth in July vs. 24% Y/Y for Q2.

“As it relates to the first 3 weeks of July, our metrics are holding up well, generally in line with Q2 when indexed to 2019.” -- Mastercard CEO Sachin Mehra

Balance Sheet

- Year to date buybacks of $5.29 billion vs. $4.78 billion Y/Y.

- Year to date dividend growth of 13.6% Y/Y.

Call & Release Highlights

Macro:

Mastercard continues to see a largely neutral macro backdrop. It’s not incredible, but it’s not awful and not worsening either. The overall labor market and elevated wage growth are both fostering resilient consumer sentiment and spend. It also called out the encouraging progress with the Fed’s policy tightening to control inflation.

Customer & Partner Wins Highlighted:

- Signed a new deal with UniCredit in Europe covering 20 million cards.

- Now has 27 million debit cards in circulation in the U.K. between 3 partnerships with vendors including NatWest and Santander.

- Deutsche Bank’s 10 million card migration to Mastercard has begun.

- Expanded its Fiserv partnership to all U.S. State and Federal benefits and wage disbursement debit programs.

- Canada’s largest federal credit union is converting its card portfolios to Mastercard.

- Tim Hortons is launching a new Mastercard-branded credit card and will use its data analytics and fraud services.

- HSBC will expand its Mastercard partnership to launch a travel rewards program across APAC.

- Inked a new deal with Alipay and WeChat Pay in China to free international inbound travelers to seamlessly link Mastercard cards to the digital wallets. China inbound travel is quickly recovering and still 50% off of 2019 levels. Good timing.

- Expanded its relationship with Expedia by integrating its loyalty program with its marketplace.

New Flows & Networks:

Mastercard is debuting the Mastercard Multi-Token Network to deliver a “set of foundational capabilities making digital asset transacting more secure, scalable and interoperable.” It sees this as being a great enabler of central bank digital currencies (CBDCs) which will be a large, large part of digital payments in the future.

Launched Mastercard Receivables Manager with Billtrust to make virtual card processing more efficient. The new offering also “automates the integration of reconciliation data into accounting systems.”

Services:

- Mastercard’s Consumer Fraud Risk solutions have already led to Trustee Savings Bank (TSB) “dramatically increasing fraud detection.” Barclays was named as another early partner for this tool.

- New Open Banking partnership with Freddie Mac to responsibly aggregate relevant consumer data for increased financial inclusion and security.

Take

The quality of this quarter was nearly identical to Visa. The same take there applies here.

2. Earnings Round-Up -- ServiceNow; Chipotle; Spotify; Enphase Energy

a) ServiceNow

Results vs. Expectations

- Beat subscription revenue guidance by 1.8% & beat revenue estimates by 0.9%.

- Beat 23% Y/Y current remaining performance obligation (cRPO) growth guidance by 200 basis points (bps).

- Beat 80.7% gross margin (GPM) estimates by 130 bps.

- Beat 23% EBIT margin estimates by 210 bps & beat the margin guidance by 230 bps.

- Beat $2.05 EPS estimates by $0.33. EPS rose by 46.3% Y/Y.

- Beat FCF estimates by 7.1%.

Guidance

- Raised 2023 subscription revenue guidance by 1%. About 40% of this raise was due to favorable currency exchange impacts.

- Reiterated 2023 gross margin & FCF margin guidance.

- Raised EBIT margin guidance 50 bps.

For the third quarter, it also guided to $2.19B in subscription revenue, a non-GAAP EBIT margin of 27% and 25.5% Y/Y cRPO growth.

“We see a sustained demand environment and pipeline for all of our product businesses, geographic regions and industry verticals. We're set up very well for a strong second half.” -- CEO Bill McDermott

Balance Sheet

- $7.5B in cash & equivalents.

- Share count is expected to rise by 1.5% Y/Y in 2023.

Call & Release Highlights

Demand Context:

- 70 $1 million+ net new transactions vs. 66 Q/Q & 54 Y/Y.

- $1 million+ contract customers rose 18% Y/Y to 1,724. These customers have an average contract size of $4.3 million vs. $3.9 million Y/Y.

- Renewal rate was 99% vs. 98% Q/Q and 99% Y/Y.

Vendor Consolidation:

ServiceNow’s ability to consolidate vendors across digital enterprise productivity has been a key selling point for it as clients seek to do more with less. For context, of its 20 largest deals signed this quarter, IT service management was purchased in 16, IT operations management was in 13, security and risk was in 17, customer workflows (which had a “sensational quarter”) was in 16 of them and employee workflows was in 14 of them. It’s signing very few new contracts with just a single offering.

Generative AI:

ServiceNow sees itself as in an ideal position to partake in the build-out of company and sector-specific large language models (LLMs). Tools include Now Assist for Virtual Agent to streamline search, Gen AI Controller which lets clients plug into APIs from vendors like OpenAI and text to code. Product releases will remain rapid as it signed a new partnership with Nvidia and Accenture to jointly go-to-market with co-developed offerings.

It will launch the latest platform upgrade later this year called Vancouver. The release will equip a large portion of NOW’s current product offerings with gen-AI augmenters. Interestingly, leadership explicitly spoke on near term opportunities to monetize these proliferating products. It sounds like ServiceNow will embrace more of a Microsoft philosophy towards monetizing vs. Amazon or Meta.

“Based on the immense value our customers will realize from our generative AI innovation, we have a clear strategy for monetization.” -- CEO Bill McDermott