News of the Week (September 5th - 9th)

The Trade Desk; Shopify; Lemonade; Match Group; PayPal Holdings; Olo; Upstart; Meta; Penn; Progyny; CrowdStrike; SoFi; Cresco Labs; Macro

To view my current portfolio click here.

1. The Trade Desk (TTD) -- Investor Conference

A Quick, oversimplified Refresher on The Trade Desk:

The Trade Desk’s Programmatic advertising niche allows for granular ad targeting. This means that when a person enters a site or an app, there can be a real time auction run in less than a second to source the most relevant ad for that buyer. The Trade Desk connects its advertising buyers to all of those impressions and explicitly tells them which to buy based on highest expected return. Publishers get higher CPMs (cost per 1,000 impressions) thanks to personalization AND buyers get a higher return on ad spend (ROAS). The Trade Desk commands a hefty cut thanks to the immense value-add it fosters via a 50% reduction in cost per impression placement and vastly enhanced return metrics.

On the unit economics of streaming:

“The math is great for streamers. When you minimize things like distribution deals with Multichannel Video Programming Distributor (MVPDs), the margins get better. Also personalization makes it so much better. The personalization makes it possible for publisher CPMs to be 5, 6, 7X what they were before because they’re that much more effective.”

Green reminded us that Hulu makes more on its ad customers than its premium subscribers. He was then explicitly challenged on how the “math could be great” if ad load falls from 15 minutes to 3-5 minutes per show. That reality is possible precisely because of the CPM boost The Trade Desk brings. It already far more than triples this metric and so a consumer doesn’t need to see nearly as many ads for an advertiser to be successful.

On Netflix and Microsoft:

“Even though most of the World heard Microsoft and was confused, I was excited about it. I have a great relationship with Microsoft and Netflix so I don’t want to overshare things they wouldn’t want me to. But in broad strokes, I would say Netflix needed a great sell-side partner. There are few strong supply partners who can guarantee inventory. One of them is Google. If you believe the future of Netflix’s business is ad-funded, it would have outsourced its future to Google if it chose them. I believe they avoided that by picking Microsoft.”

“On the buy-side, Xandr (Microsoft’s ad platform) is barely in the top 10 of demand sources. To me that means the only way Netflix can get high CPMs is to do what we advised. Where the demand side is competing against each other to win the ad opportunities for the highest CPM. By selecting Microsoft, it means Netflix is part of the open internet. That means great things for us. We can be the demand side with Xandr the supply side.”

As an aside, Green used to be an advisory board member for Xandr. The relationship is tight.

On Apple:

Green spoke against Apple more strongly than I’ve heard him do so in a long, long time.

“Apple provides a positive disclaimer on wonderful personalization for itself while showing a warning ‘are you sure you trust this company’ when asked to be tracked by anyone else. They’re hypocrites… Apple’s ad on what happens on the iPhone stays on the iPhone is one of the biggest lies in privacy.”

On UID2’s Value:

“If a player like P&G wants to use their data against Disney’s inventory, they now both have a common understanding and audit trail of where a consumer opted in to follow privacy rules. P&G gets to put their data to work in a privacy safe way with better efficacy. Disney adopts UID2 to get those high CPMs to compete in streaming with everyone else.”

On the forward (up-front) market upgrade in beta testing:

The Trade Desk is beta testing an upgraded up-front ad-buying model. It’s trying to transform up-fronts from a once-a-year process with no data usage into a real-time process with several layers of data to more closely mirror CTV’s efficacy. Tests here are ongoing but it’s early stages. To note, this is really just a way to eliminate friction while marketing spend shifts from up-fronts to programmatic. The Trade Desk wants to be a bigger part of that transition, which provides more of a right to win ad-dollars that finally move to programmatic.

Click here for my TTD Deep Dive.

2. Shopify (SHOP) -- Investor Conferences, Leadership Changes & a Shelf Offering

a) Outgoing CFO Amy Shapero Interviews with Citi

On Shopify’s Impact to the Ecosystem:

“We do an economic impact review every year. In 2021, for every $1 we made, our merchants made $38 and our partners made $7. And the communities our merchants serve generated $444 billion in economic activity.”

On Macro:

Shapero split this response into two answers: The short term and long term. In the shorter term, she reiterated 2022 as being a “re-set” year for Shopify in terms of fundamental performance. Pandemic e-commerce trends reversed more than Shopify and others anticipated and it suffered via things like layoffs as a result. So? It sees growth challenged in 2022, yet is still leaning heavily into key investments with its typical long-term mindset. This is why profit will look really bad this year and is expected to briskly improve thereafter.

For the longer term, it still sees a miles-long growth runway, ample margin expansion and consistently growing market share with e-commerce growth now back to pre-pandemic levels after the underwhelming growth we saw in early 2022.

On Fulfillment:

Shapero was asked -- for the millionth time -- about Amazon competition in fulfillment. And for the millionth time, she reminded us that Shopify is not looking to build out its own massive fulfillment network. Yes, it has a few large distribution centers. But to say it’s trying to compete with Amazon here is just not accurate. It’s using its warehouse software to move inventory from factory to port to consumer in the most efficient and affordable way possible. And it’s doing so with fulfillment partners, not a massive 1st party fleet.

On Amazon Buy with Prime:

“Merchants want to control their business and so many will never use Amazon fulfillment. We’ve always encouraged large tech to open their infrastructure. It’s a good thing. We’ve always supported approved integrations for our merchants to sell on Amazon. With respect to Buy with Prime, there’s no formal integration. It’s a disjointed process for the buyer. They have to leave the merchant’s store. We want to work with Amazon to provide an approved integration. We’re in discussions but there’s nothing new to report.”

b) President Harley Finkelstein Interviews with Goldman Sachs

On a Company Strength:

Harley offered us a condensed review of a Shopify edge: It’s ability to allow merchants to take advantage of massive economies of scale WITHOUT sacrificing their brand ownership and data is truly unique. For smaller organizations, the only options previously were to join marketplaces and lose control of their operations or expensively build internally. Now, all companies have access to these lucrative economies of scale and while keeping total control of their brand and data. So? Smaller businesses enjoy shipping rate bargaining power, marketing tools and affordable access to capital that was previously reserved for the largest companies.

On Consumer health today:

“I think there’s stabilization in consumer spending today… longer term I think we’ll settle in at industry growth rates similar to pre-pandemic.”

Harley briefly spoke on the concern over falling e-commerce penetration this year. He pointed out that the pandemic boost was largely related to physical retail shuttering and the coinciding smaller denominator when measuring e-commerce as a total piece of the pie. That brick and mortar shopping has since returned. So? While e-commerce sales in dollars have grown, commerce overall has grown (or recovered) more quickly. Growth has continued on despite temporarily falling adoption.

On Shopify Fulfillment Network (SFN):

“SFN on its own is going to make money. The unit economics are strong. We have enough merchants using it to understand that business and unit economics are already there.”

Harley covered the three main pieces of Fulfillment:

From Factory to port where it uses a Flexport partnership to ship product most effectively.

Balancing (AKA anticipating where the products need to go to which warehouse and when) to minimize last mile delivery cost. Deliverr does this for Shopify.

Shopify’s Fulfillment Management Software allows warehouses and logistics companies to use extra warehouse capacity for Shopify merchant goods while optimizing inventory and warehouse management. The logistics partners then handle delivery while Shopify gives them business. With thousands of warehouses globally below capacity, this is a tangible efficiency force multiplier.

Please note that all of this value also juices a merchant’s volumes and that benefit accrues to Shopify.

“We’re making it so that Shopify merchants don’t have to think about logistics anymore… phase 1 is our goal to do 2-day affordable deliver for 90% of the U.S. customer base. We’re about there.”

Shopify sees guaranteeing delivery time as far more important than minimizing it. For its sake, hopefully it’s right because the firm can’t match Amazon’s fulfillment speed.

Shopify Audiences:

This new marketing tool has been shown to juice ROAS by 5-7X for several merchants. The data sharing restrictions from Apple’s IDFA change has made this tool even more valuable as other forms of targeting got more difficult.

On Profitability:

“We were a bootstrap company for a long time and were not born on VC funding. That culture is in our DNA… we absolutely plan to return to profitability after 2022’s investment year.”

c) Leadership Changes

Jeff Hoffmeister was named Shopify’s newest CFO this week. He will replace Amy Shapero after this upcoming quarterly report. Hoffmeister is a banking veteran coming from Morgan Stanley and actually served as the lead underwriter for Shopify’s IPO many years ago. According to leadership this past week, Jeff “brings an understanding to the table that we don’t currently have.” This seems to be more of an intentional replacement vs. Shapero voluntarily leaving. And with as wrong as Shopify was with extrapolating pandemic trends (just like countless other companies), this does make some sense. Hoffmeister will feature a laser-focus on cost discipline to marry with Harley’s and Tobi’s ambitious philosophies on building the 100 year company. These seems like a better balance to me.

In other news, Shopify COO Toby Shannan announced his retirement from the company after 13 years of service. Kaz Nejetian was promoted from VP of product to COO to replace him. Kaz is one of my favorite executives at the company as he has played an intimate role in successful new product innovations. I view this promotion as well-deserved. According to Harley, Kaz will renew the company’s focus on “connecting the right merchants to the right products at the right time” which is something he admitted the company needed to improve at. His role will be to merge product and revenue generation in the most utility-building way possible.

d) Shelf Offering

Shopify filed a mixed shelf offering allowing it to issue more debt and equity securities in the future.

Click here for my Shopify Overview.

3. Lemonade (LMND) -- CFO Tim Bixby Interviews with KBW

On marketing & utility:

The rising cost per acquisition that Lemonade had been dealing with this year (thanks a lot Apple) has finally leveled off. The company’s acquisition cost efficiency improvements are now outpacing the higher cost per acquisition. Marrying that with what Lemonade sees as an ability to more granularly grade risk profiles is a powerful combination (if it’s legitimate).

On Partnerships:

Bixby was quick to say that direct-to-consumer (DTC) continues to be Lemonade’s main growth engine and that won’t change. Still, he sees agent partnerships as a promising longer term vector for growth. It has a few partners in its selling ecosystem now which Bixby called a test program. It plans to do a lot more with this over time.

On subtle benefits of charitable giving:

Lemonade spends virtually nothing on brand advertising or awareness. Its give back program fuels word of mouth awareness as people are proud to share the impact their insurance policy is having on the world.

This makes claimers less likely to over-exaggerate claims as now those dollars don’t all go to the insurer, but partially to a charitable organization of their choosing.

I would note that Lemonade’s give back program represents a very small percent of overall premiums. To me, this is a wildly effective marketing ploy to build loyalty and stickiness with especially younger consumers more fixated on ESG.

On Customers:

Lemonade’s customer count is now over 1.7 million vs. 1.58 million as of last quarter. This is largely due to the Metromile deal closing and Lemonade getting its 100,000 consumers.

On Profitability:

“We’re very well-funded and in a great spot. That said, we’re not profitable. We are making concrete progress toward it. We continue to expect Q3 to be our peak loss period. I’ve been looking at Lemonade models for 5 years, and that date of peak losses has not moved much. We’ve seen this point coming where we expect our losses to significantly fall to 0. That will take less than 10 years and more than 2 years. We aren’t ready to be more specific than that. We dialed back growth spend for this very purpose to avoid being forced to raise more capital at today’s rates. We have a roadmap allowing us not to raise more money.”

Meanwhile, more growth is coming from existing customers. This helps a ton with acquisition cost (often $0 for additional products added by current users) and loss ratios. As a reminder, loss ratios peak in year 1 and Lemonade’s business is growing so quickly that a large chunk of its plans are less than 1 year old.

On Reinsurance:

“We could go without reinsurance if we wanted to for a few years today with our excess capital surpluses.”

Bixby spoke on Lemonade choosing to reduce the percentage of premiums ceded to reinsurers from 70% to 55% because conditions worsened in that market. Lemonade would’ve had to accept more risk, so it lowered the portion. This was the first time I heard leadership say lowering its ceded premium rate was market related. We had been told it was a response to business maturation before these comments. I’d like more clarification on this and have reached out to the team.

4. Match Group (MTCH) -- Investor Conference & Leadership

a) CFO Gary Swidler Interviews with Evercore

On Macro and where we are in the pandemic recover:

“Data says mobility is still down in most markets vs. pre-pandemic as people are going to the office less. That being said, things are starting to normalize significantly. The effects are now relatively moderate at this point. The only markets with lingering effects are in Japan and a little in South Korea. It will take longer for Japan to come back.”

Swidler reminded us how low the marriage rate is in Japan and how the company remains optimistic on the geography’s long term prospects.

On the Consumer’s Health:

“The consumer struggled when gas and commodity prices were shocks. At that time, we did see some impact on a la carte purchasing. My sense today is that, that has stabilized. We are not seeing further deterioration from macroeconomic factors.”

“If we continue with wage growth being pretty good and unemployment being low, then I’m quite optimistic that we’ve worked through these shocks from a few months ago and reached relative stability. The business looks pretty sticky, stable and resilient… Further unemployment spikes would create a new shock.”

On Guidance:

Swidler all but told us the guidance offered last quarter was overly pessimistic. He said the company wanted to re-set expectations to get back to its trend of beating and raising and wanted to set the new CEO up for early success by adjusting guidance to meetable/beatable levels. He followed that up by saying the current guide assumed further economic worsening which has not come to fruition. If things get worse, the guide should hold true. If things stay normal, results could be even better.

“Things would have to quickly get a lot worse for me to get concerned.”

On Tinder:

“Tinder among the newer apps has 2 meaningful competitors in Bumble and Hinge. I’m happy we own 2 of the 3, but Tinder needs to face its tougher competitive reality as it no longer has the world to itself. This is when Tinder needs to step up its game. There have been a lot of good ideas over the last 4 quarters, but we haven’t executed well. We didn’t feel that the team was doing better and didn’t want to see if they could improve.”

Swidler assured us that the new team is off to a good start, has “galvanized the employee base” and that there has been no employee churn due to the leadership changes.

On Hinge’s success & expansion:

Swidler reminded us how strong organic adoption is in nations like India or France without Hinge even launching a localized app. To him, that means it’s time to accelerate international expansion and lean more enthusiastically into marketing. It will give Hinge more resources to do so.

b) Leadership

Match announced D.V. Williams as its latest Chief People Officer. He will run human resources, compensation and culture. He previously served in the same role with Cars.com and was the Human Resources Director at Tyson and Whirlpool before that.

Click here for my Match Group Overview.

5. PayPal Holdings (PYPL) -- Market Share & Leadership

a) Market Share

My friend Conor (@investmenttalkk on Twitter) posted some great research this week from Pew Research. The organization surveyed 6000+ American adults about their usage of peer to peer (P2P) payment services. And the results bode well for PayPal:

PayPal was 1st in usage at 57%.

Venmo (PayPal owned) came in 2nd place at 38% with Zelle (thousands of financial institutions use this) at 36% and Cash App at 26%.

PayPal led for every age group with Venmo in 2nd for younger demographics and Zelle in 2nd for older demographics.

PayPal and Venmo also dominated by race and income level. Cash App was notably strong with its bread & butter lower income individuals, but PayPal was still far stronger there.

Some think PayPal is a dinosaur. I think it’s a Juggernaut. We shall see.

b) Leadership

PayPal named John Kim as its newest Chief Product Officer. Kim will replace a retiring Mark Britto in a few weeks while Britto stays on for a “transitionary period.” Kim comes most recently from Expedia Group where he was the President of the company’s Marketplace. Before that, he was the president of Vrbo which Expedia purchased. He was Expedia’s Chief Product Officer before then. With Expedia, Kim transformed the marketplace into an operation with far more diverse and durable revenue channels -- a skill that will be well-received at PayPal. Kim will be tasked with fortifying and enhancing the company’s consumer and merchant product roadmaps.

“PayPal stands alone at the intersection of technology, digital payments, financial services and commerce. The scale and reputation are both true differentiators. I’m eager to work alongside the PayPal team to drive the next phase of growth.” -- John Kim

Click here for my PayPal Deep Dive.

6. Olo (OLO) -- Buyback & Mr. Beast Burger

a) Buyback

Olo announced a $100 million share re-purchase program during the week representing about 8% of its common equity. With $460 million in cash, equivalents and short term investments and no debt on the balance sheet, the company’s liquidity is surely a strength. It has also demonstrated a consistent ability to be deeply cash flow positive when it isn’t spending so aggressively on growth like it is this year.

So? While the news is a bit weird for a company this early on in its maturity, I do understand where the decision is coming from. If the $100 million is coming from budgets previously earmarked to operating expenses (OpEx), I don’t like the decision. If this is excess liquidity and a product of its strong balance sheet, I’m fine with it.

I reached out to founder/CEO Noah Glass about the move to ask him if the source of cash was coming from any other previously planned expenses. He assured me that it was the “luxury of a strong balance sheet” and “conviction to invest in ourselves without sacrificing any organic or inorganic growth.” Glass sees the company as being very well-capitalized and “having what it needs” to drive long term profitable growth. I found these words to be very comforting. And Noah, I appreciate your responsiveness and candor.

b) Mr. Beast Burger

Mr. Beast’s virtual-first burger concept set new records for attendance and sales. As a reminder, this is an Olo client -- and one that should likely be driving some meaningful net revenue expansion today. I think Olo’s dominance within medium to large restaurant chains often gets lost in appreciation. It has over 600 of the largest brands in the USA as clients and continues to add more at a brisk clip. I view it losing Subway as a one-off event rather than a trend (I could always be wrong) with positive pieces of news far outweighing this small negative.

Click here for my Olo Deep Dive.

7. Upstart Holdings (UPST) -- Credit Union

Upstart announced Vantage West Credit Union as the newest member of its referral program this week. With referrals being the largest revenue bucket for Upstart and with operations currently being funding-constrained, any additional sources of funds from ideally partners (but also capital markets) is welcomed news. I’ve said it before and I will say it many more times: Upstart’s long term viability across future credit cycles relies on its underwriting quality being strong enough to attract durable funding partners and to distance itself from fickle capital markets.

Click here for my Upstart Deep Dive.

8. Meta Platforms (META) -- Good News, VR & Ireland

a) Good News

My man Conor was on fire this week with the great research sharing. In addition to the PayPal info, he also shared Klarna’s Shopping Pulse Survey from this past month. Meta led every other platform by wide margins in terms of percent of adults who use the platform to buy a product. This isn’t just thanks to first-hand commerce, but also the company’s thriving marketplaces within its Family of Apps. Snapchat came in 2nd place in most countries, although Instagram was second in a few on them. TikTok is still far behind but rapidly making progress.

b) VR

Meta is launching an advertising campaign in Europe to demonstrate some of the use cases for the metaverse. While some people view it as predominately a vector for gaming, I could not disagree more. The Metaverse will allow med students to practice surgeries in 0-consequence environments, will allow friends from around the world to play touch football and all while adding $440 billion to the European economy by 2032. There’s a reason why McKinsey sees this as a trillion+ dollar market. Meta just needs to make sure it’s a central part of that future -- hence the historically aggressive spend today.

c) Miscellaneous

Ireland fined Instagram $400 million for its usage of teen data in the nation. Meta responded by saying the issues have already been resolved and the complaints were levied against older versions of the app.

Instagram is focusing more on advertising growth over shopping. It’s phasing out its shopping tab and will include less dedicated shopping features on the app going forward.

9. Penn Entertainment (PENN) -- Ohio

Penn’s casino in Dayton Ohio is prepping to field its first legal sports bets ever. The company is also renovating its retail sportsbook to Barstool’s brand -- a move that has been shown to vastly juice volumes in other locations.

10. Progyny (PGNY) -- Board Addition

Progyny named Lloyd Dean as its newest board member to bring its board size to 10. Dean helped found and lead CommonSpirit Health -- one of the largest non-profit healthcare providers in the USA.

Click here for my Progyny Deep Dive.

11. CrowdStrike Holdings (CRWD) -- Zscaler

For the umpteenth time, this earnings season reiterated how strong and durable the trends of cloud-based security truly are. Zscaler -- a close CrowdStrike partner operating in network security -- reported another stellar report. As a reminder, these companies frequently pull each other into large deals. This means upbeat forward demand guidance is a (weak) signal for CrowdStrike’s continued strong execution. CrowdStrike’s own guide reiterates that sentiment more directly, but it’s always nice to have supporting data points.

12. SoFi Technologies (SOFI) -- Marketing

SoFi signed LA Charger Star Justin Herbert to a 3-year deal including equity compensation. Its name was already on his home stadium, so this feels like a natural extension. Broken record alert: SoFi’s combination of tech stack integration, a bank charter, ample cross-selling abilities and lack of a national physical branch presence makes it more asset-light and efficient than most of its competitors. It takes advantage of this by inundated Americans with brand marketing and advertising. So far, it seems to be working quite well with the “get your money right” jingle firmly stuck in my head. Thanks a lot.

13. Cresco Labs -- Efficient Fundraise

Cresco completed a sale and leaseback agreement with Aventine Property Group for a facility it operates in Pennsylvania. The move adds about $45 million to Cresco’s balance sheet without any dilution or expensive interest costs. This is the first deal of this kind between the two organizations.

“The scale and quality of our operations ensure access to capital at reasonable rates with strong financing partners like Aventine -- even in volatile markets.” -- Cresco Founder/CEO Charles Bachtell

14. Macro:

a) Key Data from the Week

Institute of Supply Management (ISM) Data:

Its Non-Manufacturing Purchasing Manager’s Index (PMI) for August came in at 56.9 vs. expectations of 55.1

Its Non-Manufacturing employment index improved from 49.1 last month to 50.2 this month. This means slight expansion.

Initial jobless claims came in below expectations at 222,000 vs. 240,000 expected. The labor force remains somewhat healthy which means taming inflation is really the only priority today.

Wholesale used car prices fell by 4% last month representing the largest drop ever.

The UK is freezing gas and electricity bills for lower income families for 2 years in Response to Russia cutting off supply lines.

The U.S. Dollar set fresh decade highs vs. other major currencies. That will surely be a pain in the neck for global companies such as Match Group as it has been for much of this year.

Google will allow alternative payment methods (APMs) to be used in Japan. While this is a victory for the entire app ecosystem, there’s a large caveat to mention. It’s still charging the same 30% take rate, it’s just now giving other payment processors who are chosen their 2-3% clip. The overall take rate is what needs to come down.

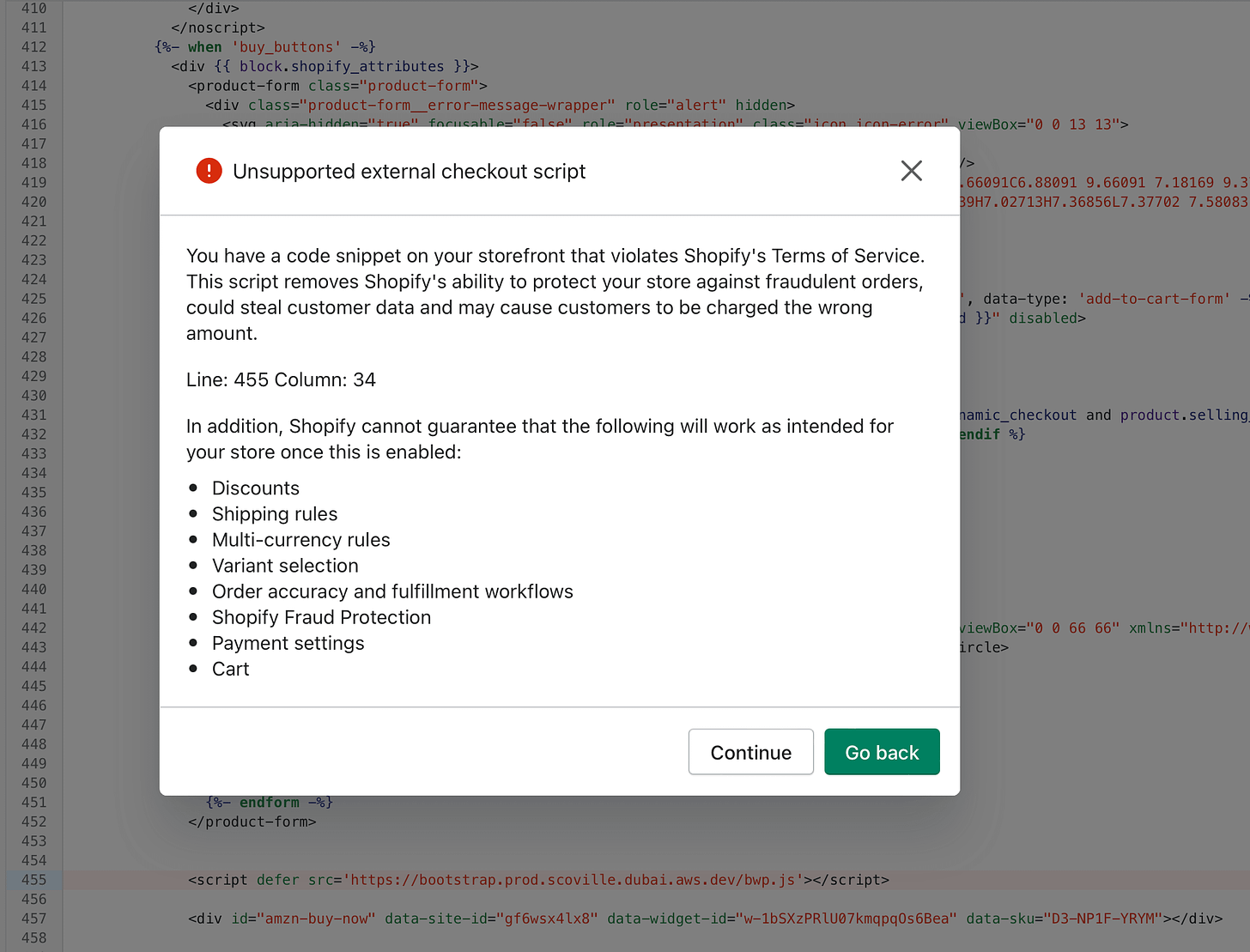

High Yield Corporate Credit Spreads continue to look better:

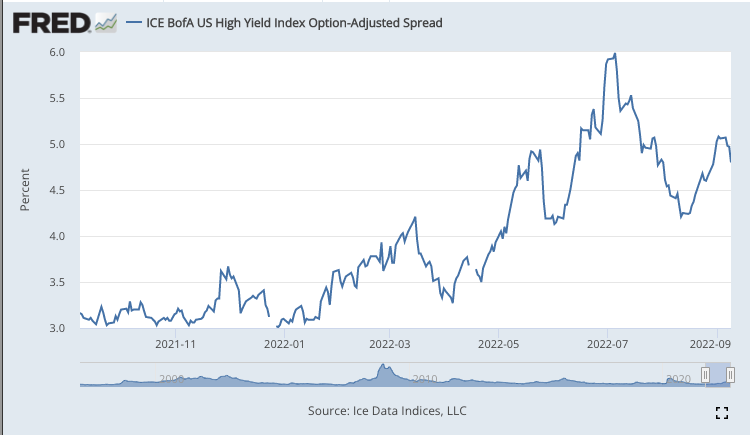

5-Year Breakeven Inflation Expectations are encouragingly near 52-week lows:

The 10 Year, 3 Month Yield Curve has still not inverted:

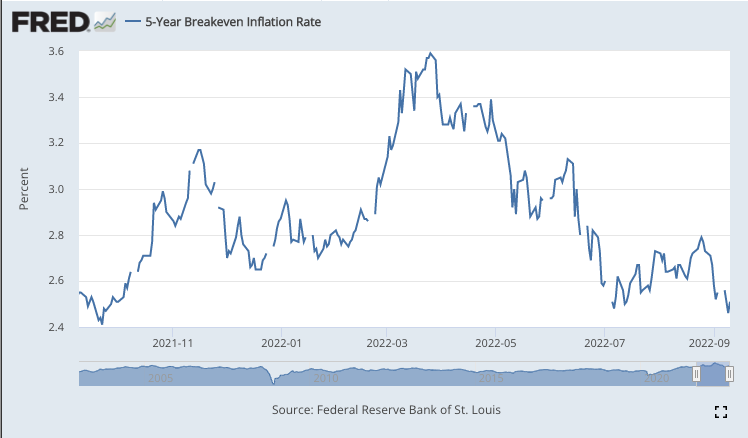

30-Year Fixed Mortgage Rates are at 52-week highs:

b) Level-Setting the Data

Inflationary readings over the last few weeks have looked better while employment metrics have been more mixed. Those positive developments could always change, but didn’t this week. These trends hint at the Fed’s tools beginning to work and our economy inching closer to allowing the Fed to pause its aggressively hawkish policy. Inflation would have to fall a lot more for that to happen, but peaking was a vital step 1. Commodity prices continue to cool while I’ve heard several executives these last two weeks in conferences tell us the macro backdrop has stabilized.

I don’t see a hawkish pause coming in the near term -- stickier pieces of inflation like rent remain hot and more rate hikes + QT are likely inevitable to combat that. At the same time, I do think 2023 will look much brighter from a macro perspective and (as readers know) I’ve begun to accelerate accumulation recently as macro green shoots have formed and strengthened that opinion. The wildcard? Renewed energy inflation due to Russia shuttering exports to Europe. That could throw a large wrench into the pattern of macro improvement and could offer me renewed accumulation hesitation. I will remain entirely data dependent in terms of position building, right sizing and cash management. While I certainly have my opinions, I will not actionably try to forecast future macro trends. I will react to them as I unfortunately do not currently own a crystal ball. I am working on my time machine though. Stay tuned.

15. My Activity

I added to Match Group during the week following the CFO’s upbeat commentary discussed above. My cash position is currently 16.1% of holdings.

If you’d like access to my real time portfolio and to sign up for text notifications when I transact, my friends at Savvy Trader now make that possible. It’s 100% free and can be accessed via the button below. Please note that the MSOS position is a placeholder for my positions in Green Thumb and Cresco Labs while OTC stocks are added to the platform. You can also re-create your very own portfolio through Savvy Trader here.

Really enjoy your thoughtful analysis. I have been a subscriber to Motley Fool. You both share conviction in some of the same stocks but your research and write ups are much more clear and insightful. Thank you

Brad

Thanks for all the updates. You wrote about Sofi:

Broken record alert: SoFi’s combination of tech stack integration, a bank charter, ample cross-selling abilities and lack of a national physical branch presence makes it more asset-light and efficient than most of its competitors. It takes advantage of this by inundated Americans with brand marketing and advertising.

Not a broken record. Perhaps the investing thesis should be at the top of every update or commentary? It is always helpful to remember why I invested in a company and then compare the recent news/events to determine 1) if the news/event has any relevance to why I invested and 2) whether or not to adjust the expectations I have for the company.

As for the new spokesperson and ad campaign, 1) it is relevant to my investment that Sofi has not changed its mission and this endorsement may help brand awareness and growth in members, and 2) doesn't change my expectations.

And about the ads. I wonder if Herbert participates in direct deposit to get the 2% interest rate. And if so, because he only gets paid 18 times a year from his employer, does Sofi still give him the 2% rate year round?

Thanks again for providing the updates and reviews.