Table of Contents

Reviews and deep dives already published this season:

- Axon Deep Dive.

- Datadog Earnings Review.

- Palantir Earnings Review.

- AMD & PayPal Earnings Reviews.

- Alphabet & Uber Earnings Reviews.

- Amazon Earnings Review.

- My Current Portfolio & Performance.

- Access 9 other reviews from earlier in the earnings season.

1. Shopify (SHOP) – Earnings Review

My Shopify Deep Dive can be found here. Most of that is still current, except for the financials, which are updated in this review. A review of its most recent Investor Day can also be found here (section 4).

a. Key Points

- Strong revenue growth acceleration.

- Growth will remain the priority in 2026.

- Spending aggressively on the future but maintaining steady margins.

- Agentic commerce should become material to results in 2026.

b. Demand

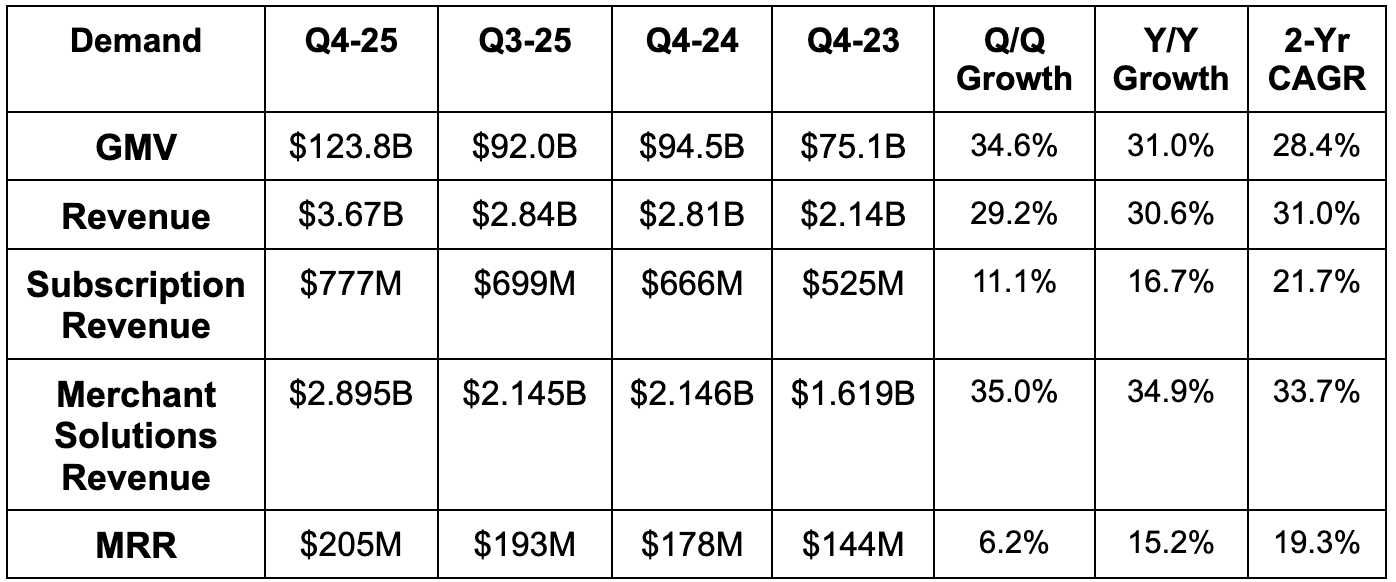

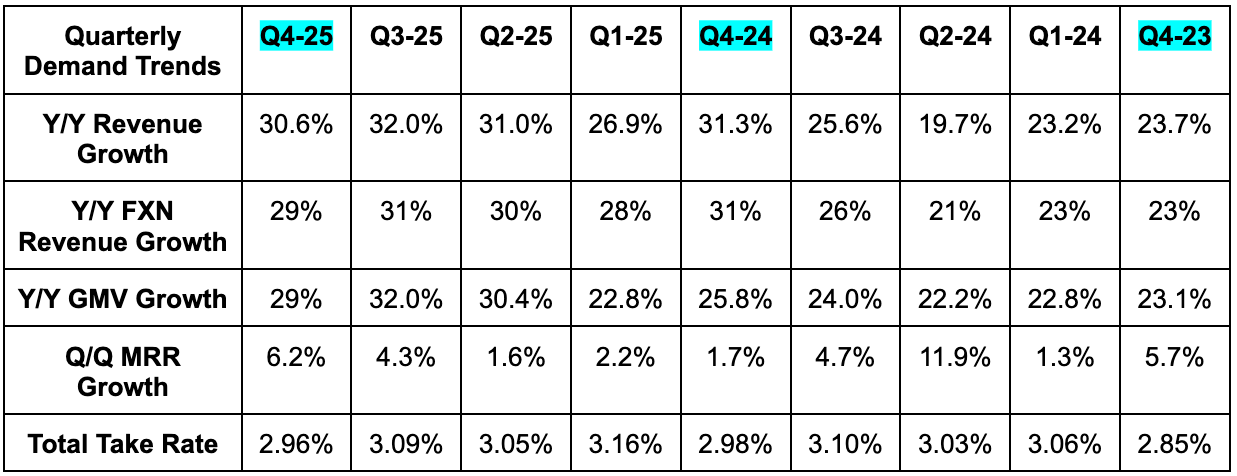

- Beat gross merchandise value (GMV) estimates by 2.4%.

- Beat monthly recurring revenue (MRR) estimates by 2%.

- Beat revenue estimates by 2.2% & beat mid-to-high 20% revenue growth guidance.

- Merchant solutions revenue beat estimates by 2.5%.

- Subscription revenue missed estimates by 1.4%.

Merchant solutions growth was powered by excellent traction for Shopify Payments and general strength throughout that entire suite. On subscription solutions revenue and MRR, things were again held back by product trial extensions implemented last year. Starting next quarter, that revenue headwind will be lapped and gone, while the positive impact this had on conversion rates should remain.

c. Profits & Margins

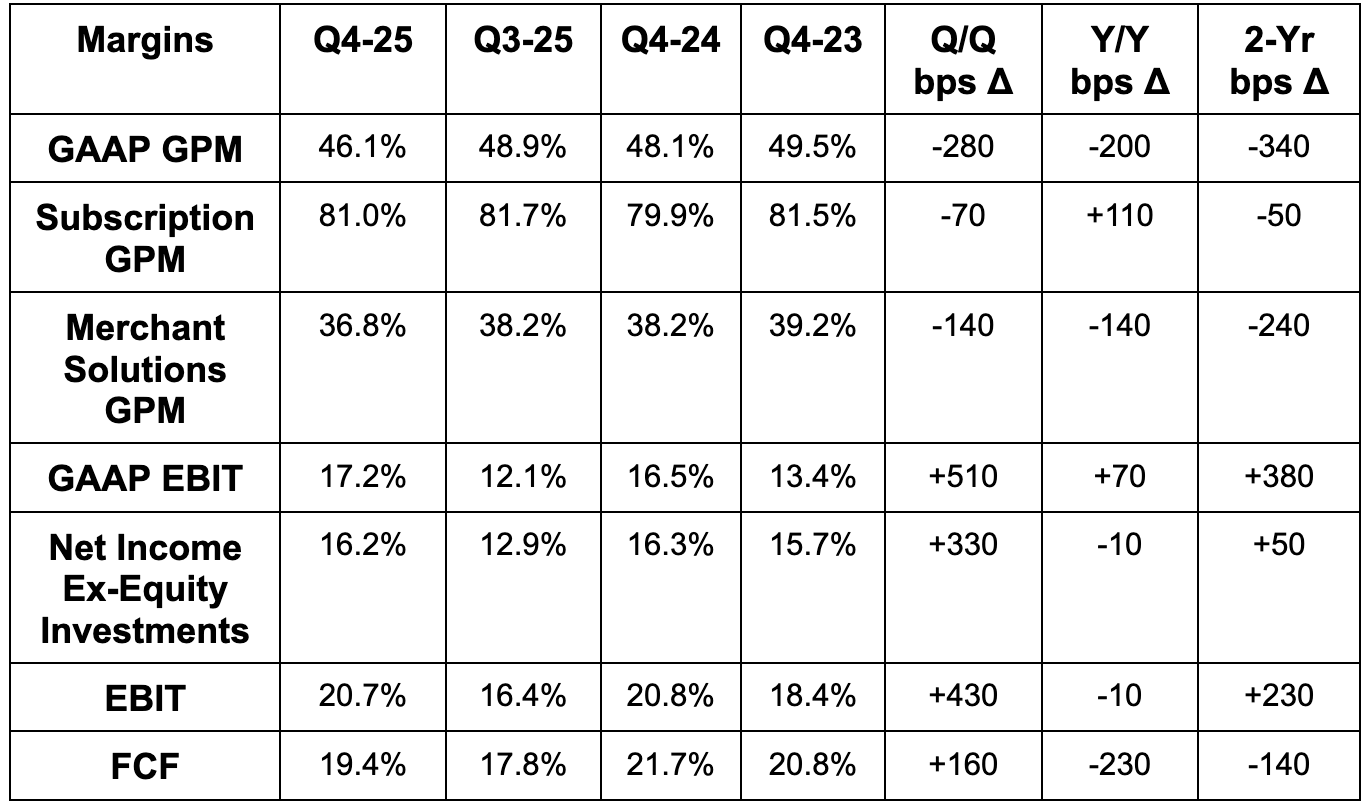

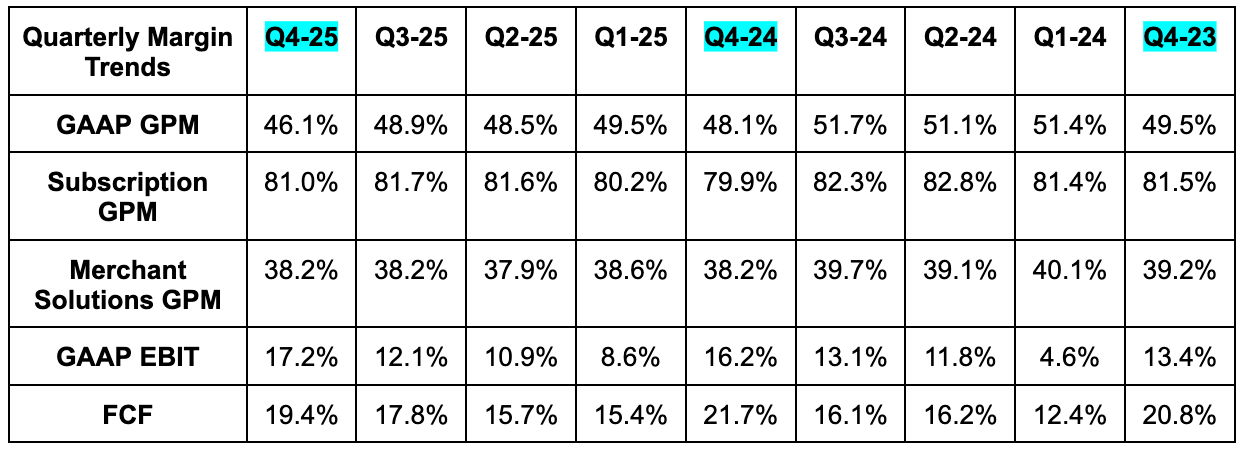

- Missed 46.5% GPM estimates by 40 basis points (bps; 1 basis point = 0.01%). 25% gross profit dollar growth beat guidance.

- Beat EBIT estimates by 7%.

- Operating Expense (OpEx) was 29% of revenue vs. 30.5% guidance.

- Beat FCF estimate by 4.4% & met its FCF margin guidance. Cash flow for the full year rose 26% Y/Y to cross $2B.

- Missed $0.48 EPS estimates by $0.02. Equity investments impact this metric every quarter, which makes it noisy and unimportant to me. EBIT and FCF are better metrics here.

Gross profit dollar growth outperformed due to revenue outperformance. Gross margin disappointed a bit due to revenue outperformance coming mainly from its lower gross margin products like Shopify Payments. Subscription solutions GPM expanded Y/Y due to support cost leverage and merchant solutions GPM fell Y/Y partially due to payment proliferation (roughly 50 bps headwind). As a reminder, Shopify is more than happy to accept this GPM headwind. The product still comes with a strong EBIT margin, delivers more overall profit dollars and creates a stickier ecosystem. Other Merchant Solutions GPM headwinds included lower 3P referral fees, as it routes more revenue through its products and rails, and its new PayPal partnership. Each of those also had about a 50 bps impact on Y/Y comps, and the PayPal item specifically has now been lapped.

OpEx for Q4 and the full year each fell by 3 points Y/Y as a percentage of overall revenue. Most of this leverage is coming through headcount growth management, which is driving efficiency across all operating buckets.

d. Balance Sheet

- $5.8B in cash & equivalents.

- $6.1B in investments.

- No debt.

- Slight Y/Y dilution.

- New $2B buyback program.

e. Guidance & Valuation

For Q1, its “low-thirties” revenue growth guidance beat 25% growth estimates. If we assume this range means 31% Y/Y growth, that’s 4.4% ahead of revenue expectations (in dollar terms). “High-20%” gross profit dollar growth guidance beat 23% Y/Y growth estimates, with the implied ongoing Y/Y GPM contraction driven again by faster merchant solutions growth. It also expects OpEx to be 37.5% of revenue vs. roughly 40% Y/Y.

Its “low-to-mid teens” FCF margin guidance missed 17% margin expectations. It sounds like this was due to an increase in Y/Y taxes for Q1, with expectations they can recoup this expense throughout the rest of 2026.

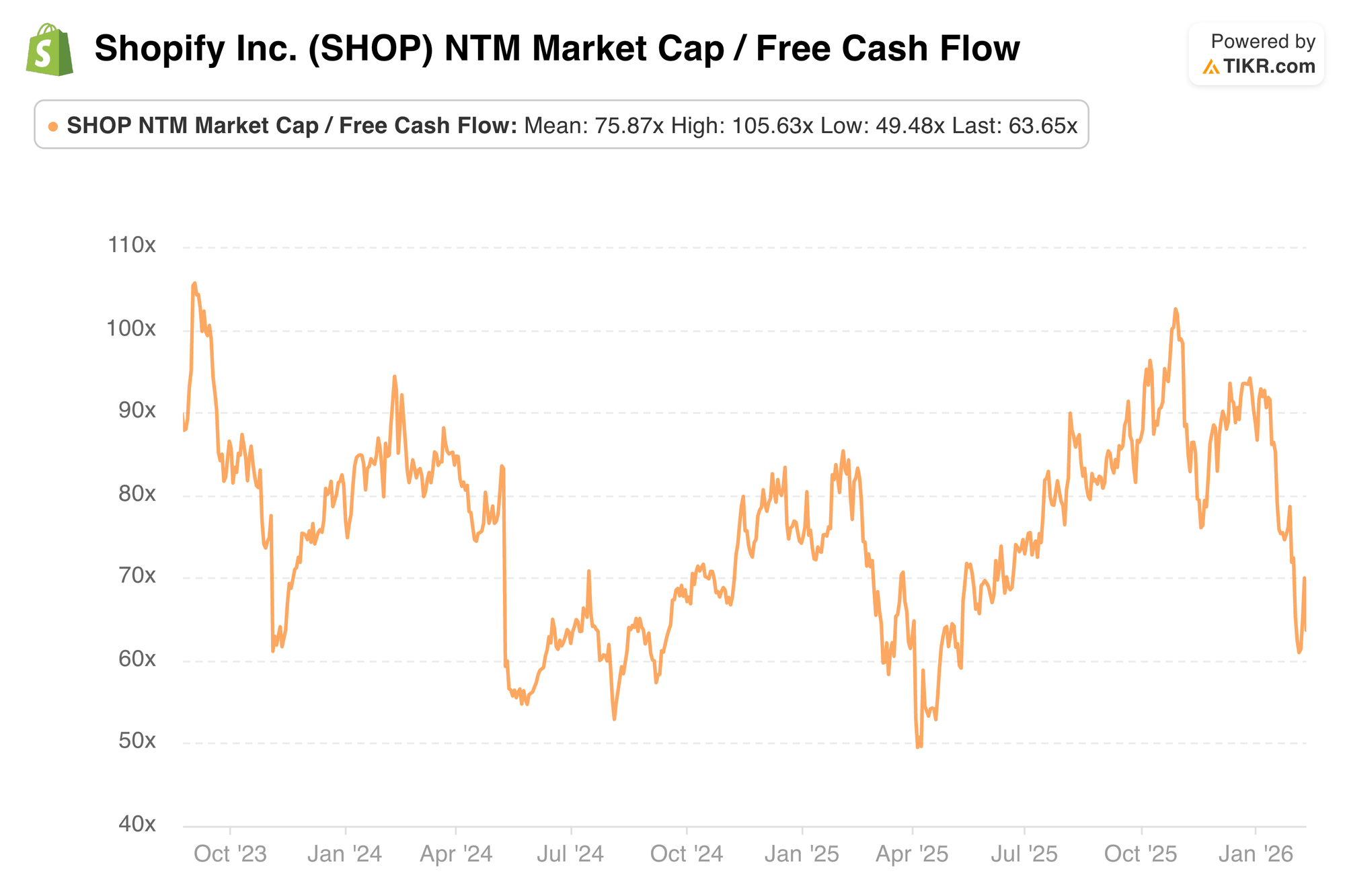

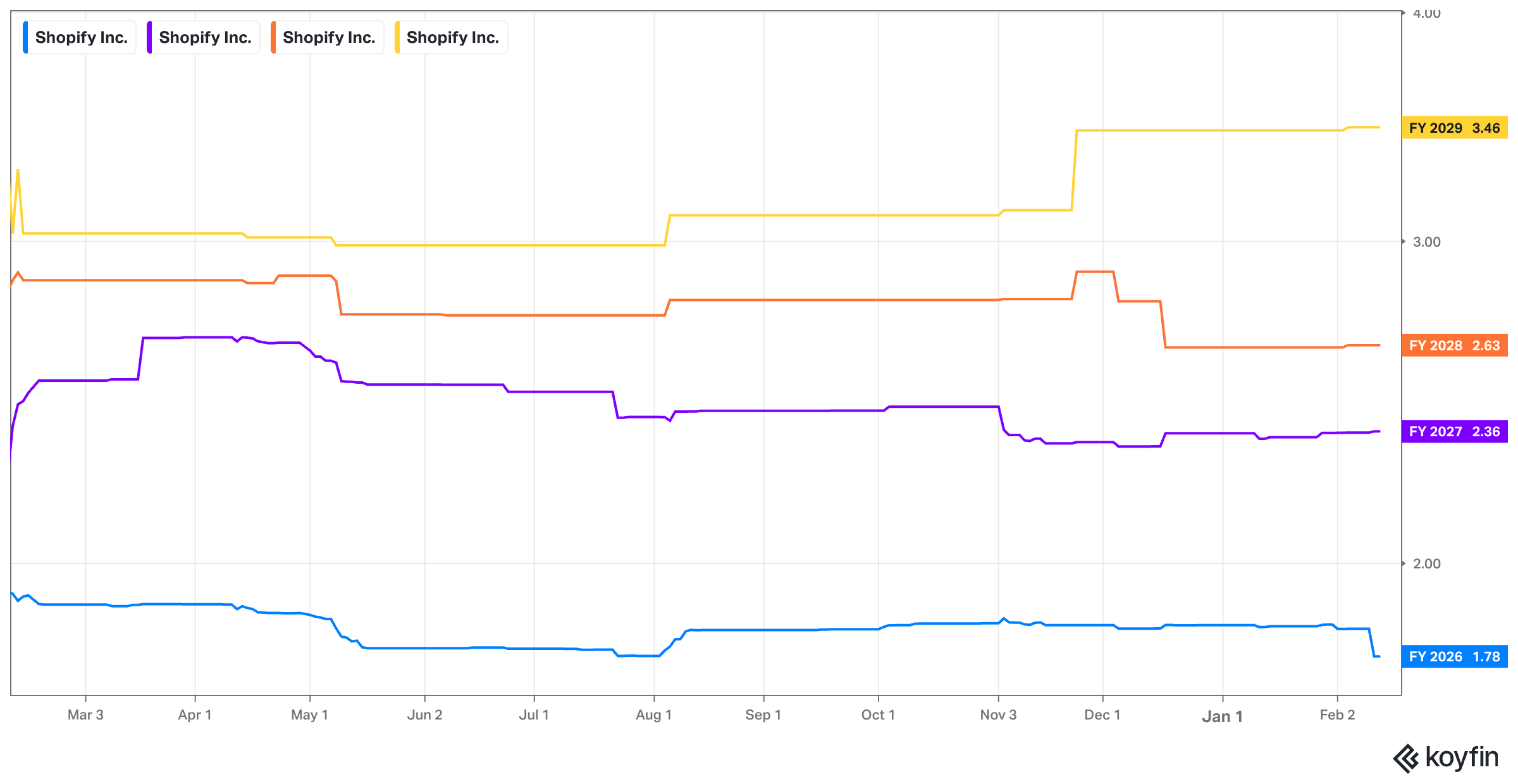

Shopify trades for 55x-60x 2026 FCF depending on where estimates end up. FCF is expected to compound at a 28% clip for the next two years.