Table of Contents

Earnings Reviews from this season:

- SentinelOne

- Snowflake

- CrowdStrike & MongoDB

- Zscaler

- Datadog & Palo Alto

- Sea Limited

- On Holdings

- Nu Holdings

- The Trade Desk

- Lemonade & Duolingo

- Palantir & Hims

- Cava

- DraftKings

- Microsoft & Cloudflare

- Uber

- Shopify & Coupang

- Meta

- Alphabet

- Apple, ServiceNow & Starbucks

- Amazon & Mercado Libre

- PayPal

- Tesla

- SoFi

- Netflix

- Taiwan Semi

My Current Portfolio & Performance.

a. Rubrik 101

My Rubrik Deep Dive, which covers the business in detail, can be found here.

Business Model & an Accounting Note:

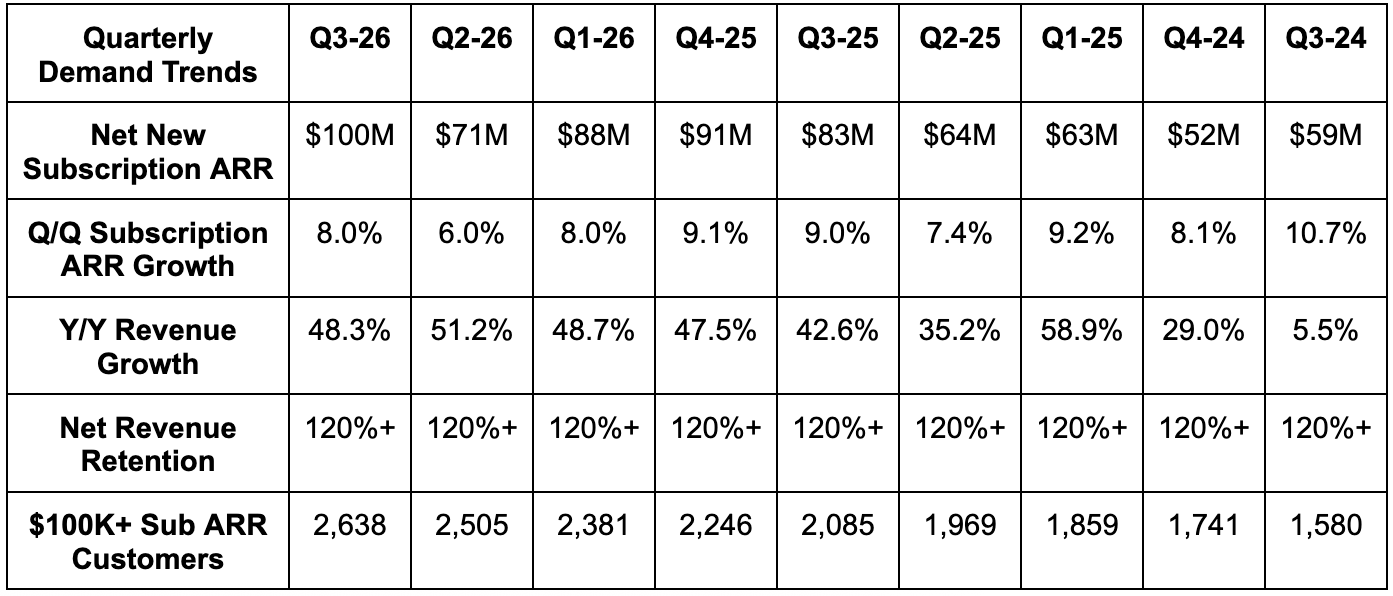

Rubrik has been shifting to a cloud-based subscription ARR model for a couple of years. It has proactively pushed customers from its licensing and maintenance revenue model to annualized cloud subscriptions. As a result, cloud ARR is rising steadily as a portion of total. This form of revenue recognition is more visible, less lumpy and entails easier cross-selling to other products. It no longer relies on hardware sales or refresh cycles.

This transition is leading to accelerated revenue recognition as it’s able to record allocated licensing reserves as revenue faster than it would have been able to (as customers shift). That’s a revenue growth tailwind this year (quantified throughout the piece) and will change to a small headwind next year.

b. Key Points

- Great identity business traction.

- Rubrik Agent Cloud (RAC) provides an exciting market expansion opportunity.

- Strong margin expansion driven by large revenue outperformance.

- New Cognizant go-to-market partnership.

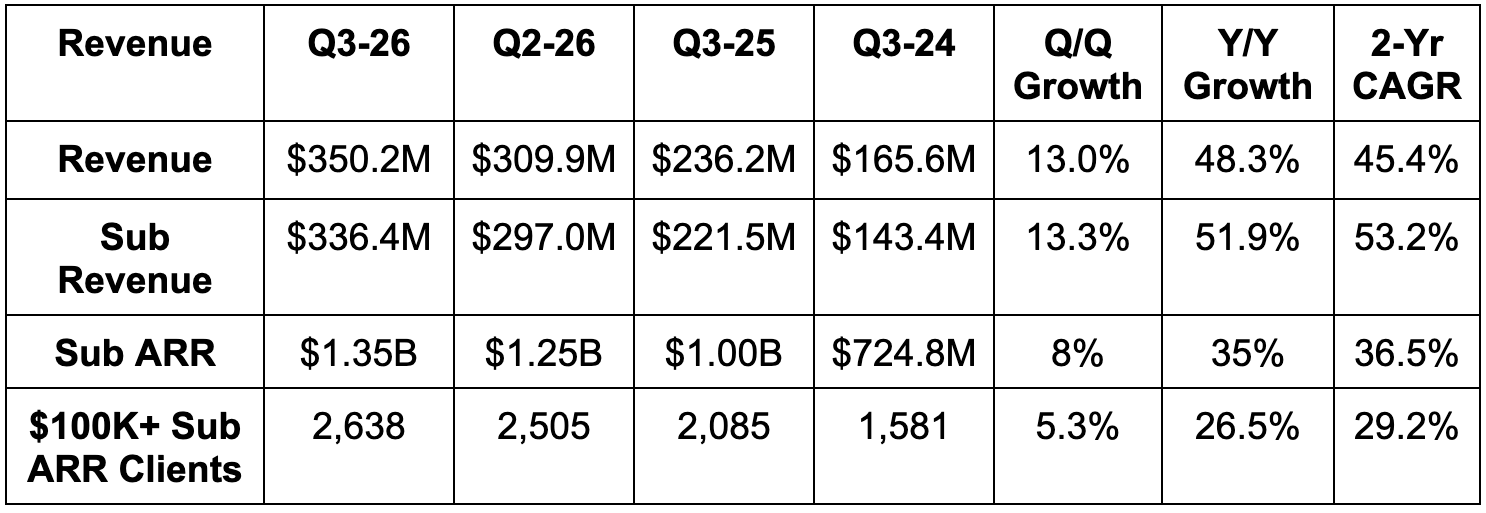

c. Demand

- Beat revenue estimates by 9.2% & beat guidance by 9.3%.

- As expected, accelerated revenue recognition from the ongoing cloud evolution added $25M to Q3 revenue. Without this help, revenue growth still would have been an impressive 36% Y/Y.

- Beat subscription revenue estimates by 9.2%.

- Beat subscription ARR estimates by 2.6%.

- Met $100K+ subscription ARR customer estimates.

- They added a record 23 new customers with $1M+ in ARR.

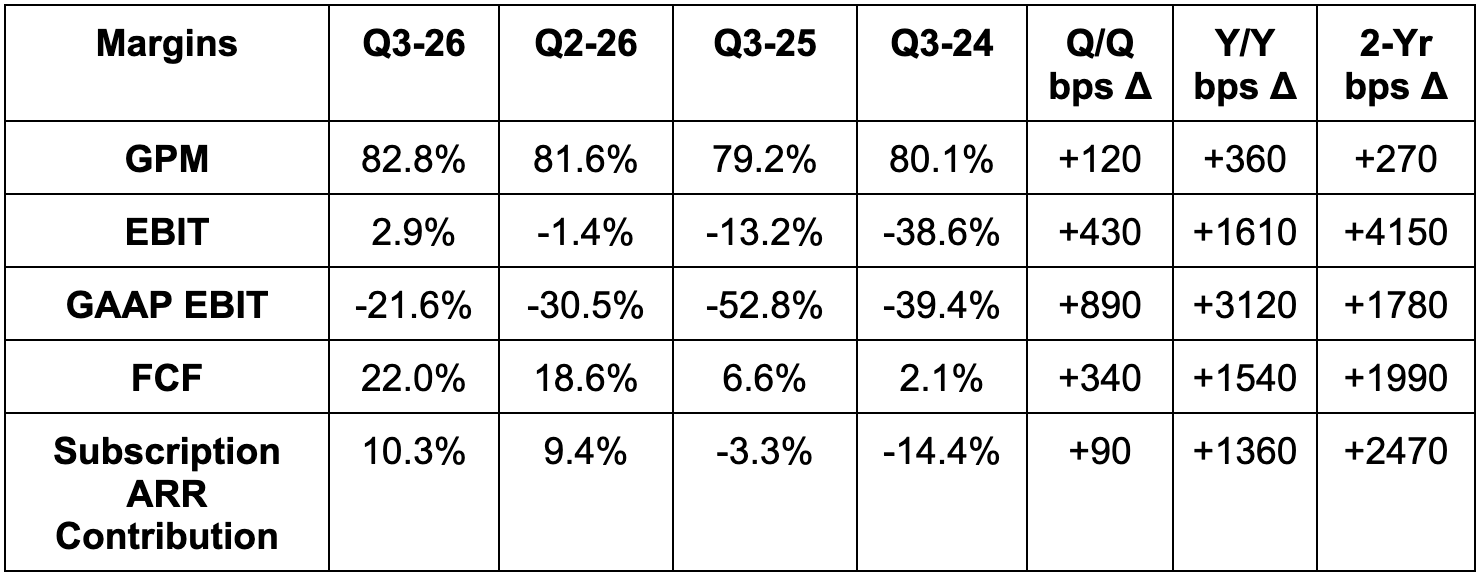

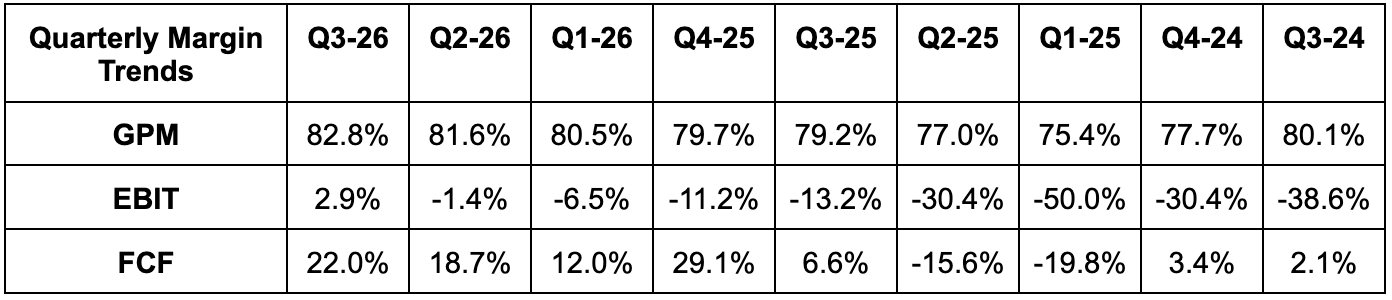

d. Profits

- Beat 78.7% GPM estimates by 410 basis points (bps; 1 basis point = 0.01%).

- Beat -$42M EBIT estimates by $52M.

- OpEx rose by just 17% Y/Y, greatly trailing revenue growth and adding to the explosive Y/Y leverage.

- Beat -$0.17 EPS estimates by $0.27 & beat -$0.17 guidance by $0.27.

- Beat $28M FCF estimates by $49M.

- Beat 6.5% subscription ARR contribution margin estimates by 380 bps.

Strong revenue outperformance led to the sharp margin outperformance.

e. Balance Sheet

- $1.6B in cash & equivalents.

- $1.1B in convertible notes.

- Diluted share count rose by 8% Y/Y. This is still being impacted by the IPO.