Table of Contents

1. Broadcom (AVGO) – Earnings Review

a. Broadcom 101

Broadcom designs a slew of semiconductor equipment for AI training/inference, networking, mobile and more. It doesn't design Graphics Processing Units (GPUs) like Nvidia, but it does help giant customers create and coordinate the manufacturing for more specialized chips. These are called XPUs, with the "X" meaning it's a variable processing unit and customizable piece of hardware. Alphabet's tensor processing units (TPUs), which Broadcom co-designs, are an example. XPUs do not do nearly as much as a GPU can, but they're highly capable for specific machine learning tasks that are paramount for AI work. They're specialists, while GPUs are generalists.

Its semiconductor solutions business includes a range of chips that function as switches with world-class throughput. The Ethernet-based Tomahawk 6 product for data centers is a key example. These deliver great bandwidth gains, which bolster and accelerate data center networking.

It also offers a range of software tools, which significantly broadened out with its VMware acquisition. VMware offers virtual, localized layers of software that sit on top of hardware. This allows the centralized hardware to run several different operating systems from the same place. The company, which is now a Broadcom unit, calls this offering a "virtual private cloud" (virtual machine). Finally, VMware also gives AVGO more software-based tools to optimize its various semiconductors, providing compelling upselling potential.

b. Key Points

- AI chip revenue keeps accelerating.

- They added a 5th major customer this quarter.

- Anthropic followed their $10B chip order last quarter with another $11B order this quarter (good for both Broadcom and Alphabet).

- The Tomahawk 6 Switch is dominating.

c. Demand

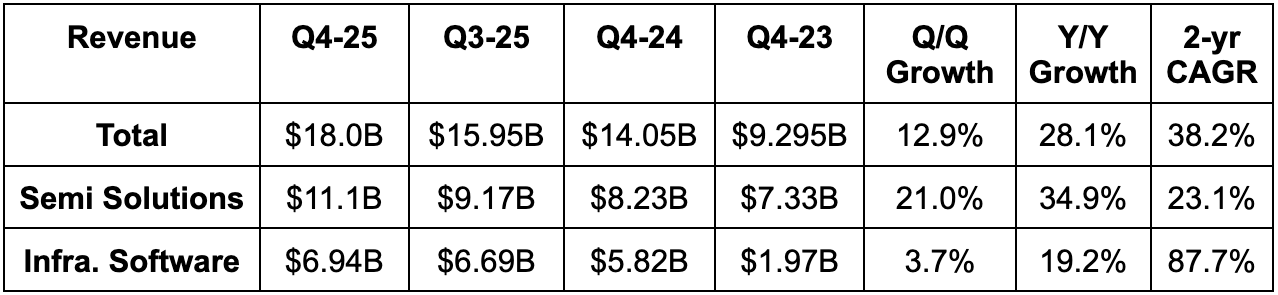

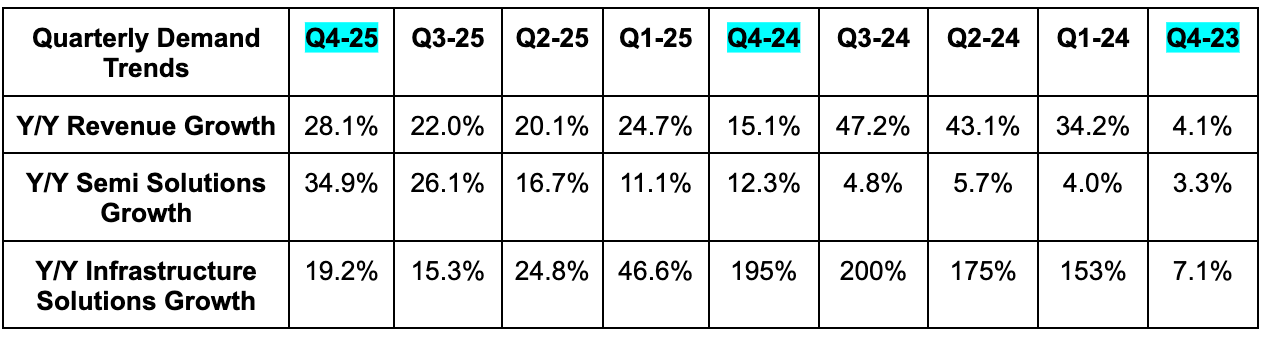

- Beat revenue estimate by 3.1% & beat guidance by 3.4%.

- Semiconductor (semi) solutions revenue beat estimates by 3.0%.

- AI semi solutions revenue of $6.2B rose 66% Y/Y and met AVGO guidance.

- Non-AI semi solutions revenue met estimates.

- Infrastructure (infra.) software revenue beat estimates by 3.3% and beat guidance by 3.6%.

- Revenue for the full fiscal year (FY) rose by 24% Y/Y vs. 44% growth last year and 8% growth the year before.

d. Profits & Margins

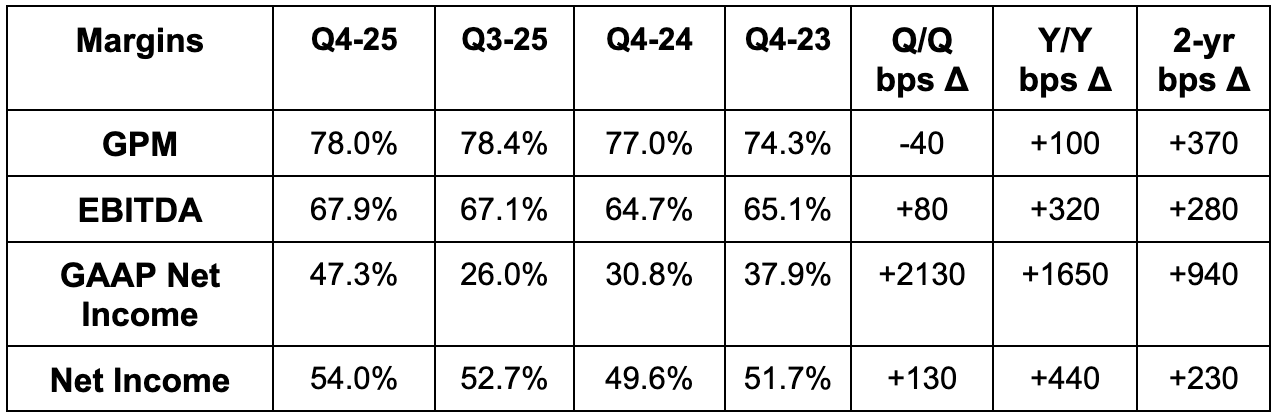

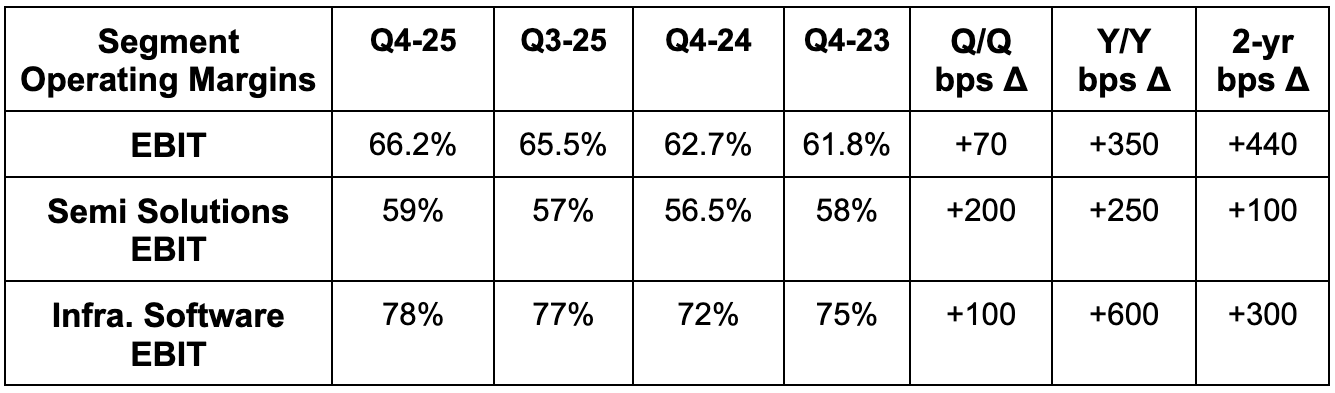

- Beat 77.7% GPM estimates & identical guidance by 20 basis points (bps; 1 basis point = 0.01%).

- Beat $1.87 EPS estimates by $0.08.

- Beat EBITDA estimates by 4.9% & beat guidance by 4.8%.

- EBITDA rose by 34% Y/Y.

- Infra. software EBIT was helped by wrapping up VMware integration work.

- EBITDA margin expanded Q/Q despite the Q/Q GPM decline due to strong and broad-based leverage across operating expense (OpEx) buckets.

- Missed free cash flow (FCF) estimates by 19%. This metric is very noisy on a quarterly basis, as it's tied to cadence of payments & collections. It is best to focus on annual FCF generation.

e. Balance Sheet

- $16.2B cash & equivalents.

- Inventory rose by 29% Y/Y – nearly in line with revenue. Days of inventory on hand fell from 66 days to 58 days Q/Q.

- $65B total debt.

- Dividends rose by 13% Y/Y. Dividends will grow by 10% Y/Y next year.

- 1.2% Y/Y diluted share count growth. They've gotten through the sharp dilution associated with their VMware purchase.

- Broadcom has $7.5B left in buybacks (under 4% of the giant market cap) and just extended that program through the end of FY 2026.

f. Guidance & Valuation

Revenue and EBITDA guidance for next quarter beat estimates by 4.4% and 6.7%, respectively. I'd anticipate that fiscal year (FY) 2026 estimates rise a bit following this report. There were two questions during the call that likely led to some price volatility after-hours. First, they were asked to commit to Y/Y income statement margin leverage for next year and declined to do so. GPM was already expected to modestly fall in 2026, as Broadcom is shifting to more system-wide sales, with more components from other vendors that fetch a piece of the overall profit. These system-wide sales have more mouths to feed, so this wasn’t a surprise. But? Sell-side consensus was looking for 50 bps of EBIT margin leverage and 150 bps of net income margin leverage, so that’s modestly disappointing. Second, CEO Hock Tan was asked to reiterate that AI revenue growth would accelerate compared to this year. He said he didn’t want to make that commitment at this time, but called it likely and seemed to point to 60%-70% Y/Y growth as a decent range to work from (compared to 65% growth this year). That’s excellent at its scale, but there’s a massive $32B-$40B sell-side estimate range for this. That range represents 60%-100% Y/Y growth, with Broadcom’s stated range towards the low end of that.

- Q1 GPM guidance of 77% slightly missed 77.2% estimates.

- Guided to 100% Y/Y AI semiconductor revenue growth to reach $8.2B.

- Guided to $6.8B in infrastructure software revenue growth, representing just 2% Y/Y growth. For FY 2026, they reiterated low double-digit growth for this segment.

As of right now (pre-revisions), AVGO trades for about 43x FY 2026 EPS. EPS is currently expected to grow by 52% next year and by 46% the following year.

g. Call & Release

Semi Solutions – AI Chips:

AI compute revenue rose 74% Y/Y to $6.5B and exceeded internal expectations. Within this, its XPU business grew by 100%+ Y/Y, as it secured larger deals for its 4 giant customers to run their AI workloads and build their models. As leadership rightfully and excitedly pointed out, these XPUs are now also being sold by Broadcom’s customers to other external companies. Tan is talking about Google and their TPUs (where Broadcom is a key design and manufacturing coordination partner). Last quarter, this generated a $10B TPU order for Anthropic to deploy these custom accelerators, while another $11B TPU order came from Anthropic this quarter.

- Again, most of these big contracts are for system-wide deployments, rather than stand-alone XPUs. That means, for example, that high-bandwidth memory chips are included. Those vendors need to be paid.

Outside of Anthropic and Google, Broadcom’s other 2 giant and established customers are also leaning into larger contracts to power their own XPUs (not TPUs in this case). And furthermore, Broadcom also announced a 5th AI compute customer this quarter, with a $1B order placed for next year. The company was asked to confirm if this was OpenAI. This curiosity stems from recent news of a 10-gigawatt compute deal between AVGO and OpenAI, but that’s mainly for networking equipment, not TPUs. And furthermore, that deal will ramp meaningfully in 2027, while this $1B deal will be executed in 2026. Meaning? This $1B TPU order is separate and could have been them or some other company. We don’t know for sure.

Semi Solutions – AI Networking:

On the networking side, “demand has never been stronger.” The star of that show is the Tomahawk 6 switch (Ethernet data center switch), which provides an unmatched switching capacity of 102 terabits per second. That is leading to an unprecedented ramp for the product, but it’s not the only networking tool delivering strong results. For example, its digital signal processors (DSPs) are data processing order and hygiene specialists. They ensure this processing and insight moving through data centers is understood and optimized. This bolsters hardware efficiency and unlocks better inter-data center communication and more scaling-out (connecting more server racks) potential.

- AVGO’s AI order backlog sits at $73B today and will be executed over the next 6 quarters. This is not a 6 quarter AI revenue guide, it is a minimum revenue guide for that period. $53B of this is XPUs, with $20B being the rest of its AI products.

Semi Solutions – Non-AI:

Broadband was the standout for this category, while wireless was flat Y/Y and every other category declined. The enterprise backdrop is showing “limited signs of recovery,” which led to the 0% Y/Y growth guide for this segment in Q1. They still think they’ve found the bottom for this cycle, but seem to think the recovery they started to get excited about last quarter slowed a bit. That’s why the (great) leadership team told us last quarter not to get excited about a few weeks of stronger trends. They’ve been “tricked” before and wanted to wait for those trends to grow more durable to become optimistic. That didn’t happen.

Infrastructure Software:

Bookings growth for this segment remains at a strong 26% Y/Y clip, while margins are exploding higher with VMware integration work in the rearview. We did not hear much about this segment. They’ve essentially finished migration to the VMware Cloud Foundation (VCF) offering. As a reminder, VCF “enables the entire data center to be virtualized and customers to create their own private cloud environment on-premise.” This frees them to run their apps in reliable, scalable places other than in a public cloud. And that's a timely addition to AVGO's value prop. With data leakage a heightened risk and focus area in the age of GenAI, many customers are re-thinking how much of their infrastructure they'd like to maintain privately. Now that the VCF evolution for the existing base of customers is finished, they will increasingly focus on workload growth for the segment.

What a successful purchase this was. Broadcom seamlessly laced VMware into its operations, while consistently raising synergy targets and revenue expectation. No headache. Just execution. Refreshing.

Competition from your customers?

Analysts wanted to hear from leadership on their views of recent newsflow. We’ve heard mumblings of Alphabet trying to do more of their design and manufacturing coordination work internally and with other partners. The risk isn’t Broadcom customers replacing them… it’s these customers replacing a part of what they provide and assuming more responsibility. And we’ve heard a steady theme of companies wanting to vertically integrate as much of this as they can to optimally compete on cost structure. If we’re going to have a world with a few similar and giant LLMs, giants will be those that can operate at a better cost structure, enabling them to pass on value and delight to customers where others can’t profitably do so.

While they fully understand and respect this notion, they don’t seem overly concerned. As Tan mentioned, budgets are finite. And these custom chip players are trying to build products good enough to justify not paying GPU vendors a fortune. Nvidia is moving rapidly… and these companies have several other priorities beyond potential chip vertical integration. He’s confident they’ll keep leaning on Broadcom to greatly assist them in performance gains and optimization to free them from reliance on king Nvidia. He called this risk overblown and sensationalized by financial media.

More Notes:

Broadcom has what it views as strong photonic fabric technology to enhance low-power compute connections. Still, the industry and tech will take several more years to evolve to a point of this innovation meaningfully and commercially scaling. For now, copper is still much easier to use and better.

They are doing more in chip-on-wafer-on-substrate (CoWoS) packaging as their XPUs require more and more chips per unit. That’s what the new Singapore facility is for. At the same time, they’re not interested in doing this for silicon. They’ll keep using Taiwan Semi.

h. Take

Great quarter. They’re rapidly growing at a massive scale and generating the kind of backlog that will support brisk growth in FY 2026. They’re also doing this at sky-high margins. Good combo.

And while these numbers were absolutely strong, expectations were higher. Analysts wanted Broadcom to concretely commit to a meaningful AI revenue growth acceleration beyond 65% Y/Y. They did not do that. They left the door open for it, but intentionally didn’t make that promise. Some overly excited analysts brought their AI revenue estimates as high as 100% growth for next year, and this fell short of that. Does that mean the performance was bad? No. 60%-70% AI growth on a base of $20B is remarkable. Expectations were just a tad more remarkable. That’s what happens when a stock and its forward multiple zoom higher and higher. The benchmark to “positively surprise” analysts zooms higher and higher too. That doesn’t mean the stock won’t recover within a day, but it’s probably why amazing numbers like this aren’t being immediately rewarded.

What matters most for investors hoping to hold this thing for years to come? Strong, durable and margin-accretive growth. That is imperative to justify a company trading for 43x forward earnings vs. its trailing 10-year average of 18x.

Cycle longevity will determine whether or not they can deliver this needed growth going forward. Broadcom results will likely remain elite for as long as this AI infrastructure cycle keeps rocking. Mega-cap CapEx plans, increasingly compute-hungry models, falling cost of capital and brisk chip performance gains all point to this cycle still having legs. And if it does… Broadcom will too.

I gravitate towards structural compounders where cycle timing isn’t nearly as important as it is here. I want the success of my holdings to be more in their control than it is for AVGO. Nobody is immune to macro… but many are more insulated. Effective cycle timing is vital for this investment and also quite difficult. I love the company and team, yet I don’t own shares because of this.

See my portfolio & performance vs. the S&P 500 here.

2. Oracle (ORCL) – Earnings Review

Upgrade to lock in exclusive discounts and read the Oracle review. Subscribers also get ~40 other reviews every single season.

Earnings Reviews from this season:

- Snowflake

- Rubrik

- CrowdStrike & MongoDB

- Zscaler

- Datadog & Palo Alto

- SentinelOne

- Sea Limited

- On Holdings

- Nu Holdings

- The Trade Desk

- Lemonade & Duolingo

- Palantir & Hims

- Cava

- DraftKings

- Microsoft & Cloudflare

- Uber

- Shopify & Coupang

- Meta

- Alphabet

- Apple, ServiceNow & Starbucks

- Amazon & Mercado Libre

- PayPal

- Tesla

- SoFi

- Netflix

- Taiwan Semi

You'll also get coverage of all relevant company events within our large network and real time portfolio & performance updates every time I make a change. My Current Portfolio & Performance.

And finally, you'll get access to a discord room full of polite, mature and thoughtful investors to collaborate with (and ask me questions).

StockTwits users currently get exclusive discounts... what are you waiting for? Sign up below.